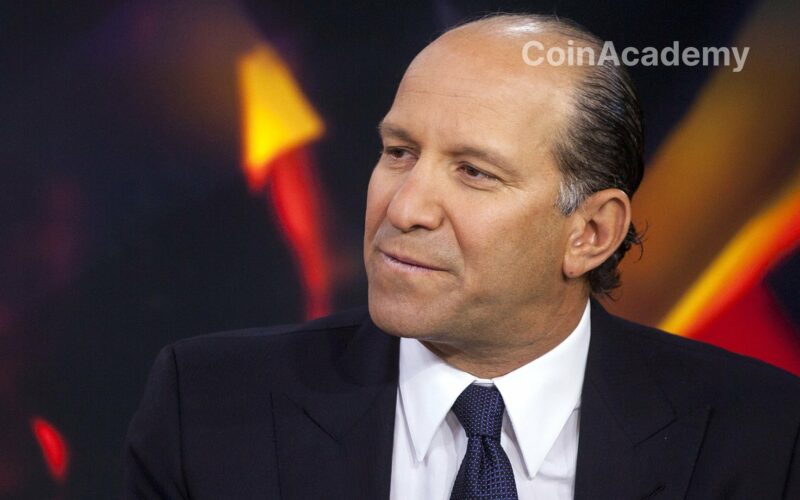

During the World Economic Forum in Davos, Howard Lutnick, CEO of Cantor Fitzgerald, shared his insights on the new Bitcoin cash ETFs in the United States and the role of cryptocurrencies. According to him, these ETFs will primarily be a means for Americans to buy Bitcoin, but their impact on overall confidence in cryptocurrencies will remain limited, especially due to the market volatility last year.

The Role of Cantor Fitzgerald in Managing Tether

Lutnick’s stance on Tether is particularly relevant as Cantor Fitzgerald, the company he leads, is responsible for managing Tether Holdings’ portfolio of US Treasury securities. Lutnick reassured about the solvency of Tether by stating:

We manage a significant portion of their assets. […] Based on our observations and in-depth analysis, they do possess the funds they claim to have.

Controversies and Financial Assurance of Tether

Tether has been criticized for its opaque accounting practices and received a poor rating in the stability assessment of stablecoins by S&P Global. Despite issuing attestations, Tether has never been audited and has been subject to rumors about its financial situation. Its latest attestation report dates back to October 31, 2023, and showed impressive financial health but did not mention its debts.

In February 2021, Tether and its parent company Bitfinex entered into an agreement with the New York Attorney General’s office, requiring them to submit quarterly reserve reports for two years. Tether is currently working on a real-time reserve reporting system that could be deployed in 2024.