|

Getting your Trinity Audio player ready...

|

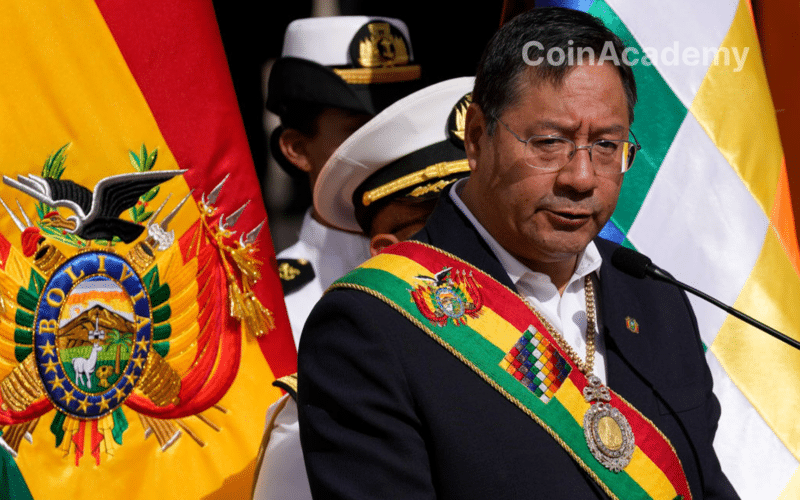

Bolivian President Calls for De-Dollarization and Diversification

Bolivian President Luis Arce called for the de-dollarization and the diversification of the economic relations of the Latam region. After concluding his participation at the Southern Common Market Summit, Arce reinforced the importance of the de-dollarization process of Latam, stating:

Our region is seriously affected by the restrictions imposed by the northern financial system, which limits financing options, making it necessary to reduce dependence on the U.S. dollar and diversify our economic relations.

Furthermore, Arce mentioned China and the BRICS as possible partners to help in this diversification push. Arce finished explaining that the region was “experiencing a crucial moment of transition towards a multipolar world that guarantees a balance of powers.”

In May, Arce called the Central Bank of Bolivia to research if the country could also mimic the recent advancements in the Chinese yuan’s usage in countries like Argentina and Brazil.

Reserve Drops Fiat Services in Six Countries

Reserve, a cryptocurrency exchange platform, announced it was dropping fiat-based services in six countries: Argentina, Colombia, Peru, Venezuela, Ecuador, and Panama. In a statement, Gabriel Jimenez, CEO of Rpay and former Petro developer, explained that liquidity in fiat currencies would be available until August 3.

After this date, the platform will switch to operating using only cryptocurrencies in these countries. Jimenez declared that the reasons behind this measure were related to “sustainability issues associated with cryptobanking challenges.”

As a result, Reserve, which had been focused on Latam markets, also announced a change of strategy, now directing its effort to establish a foothold in the U.S. to create a “pathway for global expansion.”

Argentina Postpones $2.6 Billion IMF Payment

The government of Argentina announced it would postpone two payments to the International Monetary Fund (IMF) until the end of July. The government deferred the delivery of these payments — which amounted to 2.6 billion — as it is still in talks to accelerate the disbursement of part of the loan of the IMF to the country.

Recently, Argentina settled part of a $2.7 billion payment to the IMF using the Chinese yuan and IMF’s Special Drawing Rights (SDR) due to the low dollar liquidity that the country is experiencing.