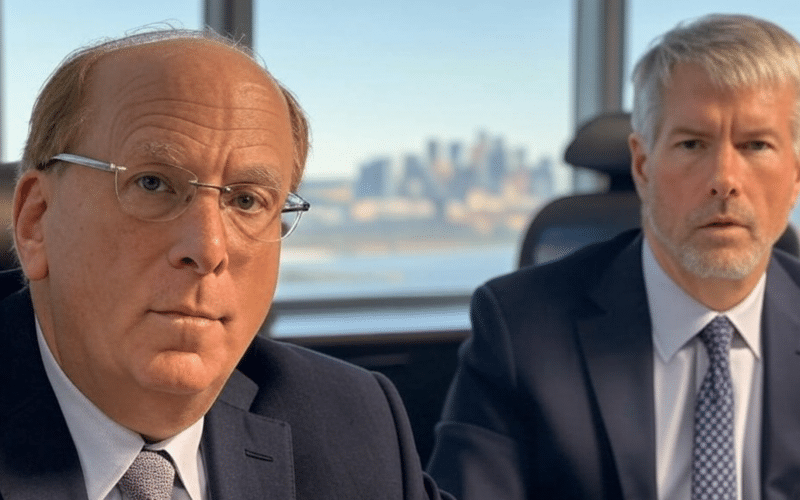

BlackRock Increases Stake in Strategy, Validates Bitcoin Maximalist Strategy

BlackRock, a global asset management giant, has recently raised its stake in Strategy (MSTR) to 5%, according to a regulatory filing. This acquisition represents approximately 11.2 million shares, indicating a 0.91% increase compared to the 4.09% held in September 2024.

Such a statement is required when institutional investors exceed the 5% threshold in a listed company, provided they do not intend to take control. BlackRock filed its report on December 31, 2024, thus complying with the regulatory window requiring a disclosure before February 14, 2025.

STRK Surges After Nasdaq Debut

In parallel with this announcement, Strategy’s perpetual preferred share (STRK) made its debut on the Nasdaq, recording an encouraging first day of trading. STRK closed with a 2% increase after trading over 650,000 shares.

The optimism among investors did not stop there, as STRK continued to rise in pre-market, gaining an additional 5%. This momentum reflects growing interest in the stock and renewed confidence in the company’s Bitcoin maximalist strategy.

A Strong Signal for Strategy’s Future

The increase in BlackRock’s stake in Strategy is a key indicator of large investors’ interest in the company and its business model. BlackRock, as a global investment leader, does not make such decisions lightly. This increased involvement could enhance Strategy’s credibility in the markets and attract other financial institutions looking to secure a position in the company.

The performance of the STRK stock and BlackRock’s increased involvement could mark the beginning of an expansion phase for Strategy, which now enjoys increasingly solid institutional support.