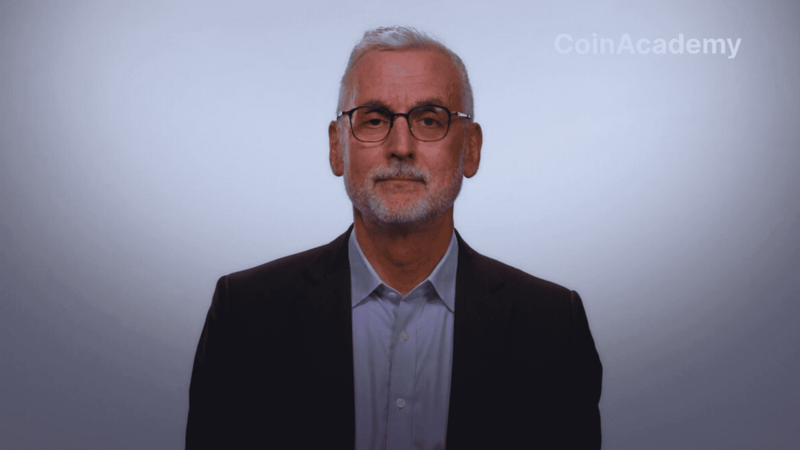

Larry Fink, BlackRock CEO, Deems Bitcoin a Legitimate Financial Instrument

Larry Fink, CEO of BlackRock, has reiterated that Bitcoin is a legitimate financial instrument that everyone should consider holding.

This statement comes as BlackRock has released better-than-expected second-quarter results.

Performance of BlackRock’s Bitcoin ETF

BlackRock’s iShares Bitcoin Trust (IBIT) added $4 billion in assets during the second quarter, bringing the total to over $18 billion since its launch in January.

This significant growth reflects investors’ increasing interest in Bitcoin, even in a volatile financial environment.

Larry Fink’s Context and Perspectives

Former Bitcoin skeptic Larry Fink admitted that his opinion on Bitcoin has evolved over the years. “My opinion five years ago was incorrect,” he said in an interview with CNBC.

I believe Bitcoin is a legitimate financial instrument.

This recognition of Bitcoin by the CEO of the world’s largest asset manager aligns with the growing acceptance of cryptocurrencies in traditional financial circles.

Fink’s endorsement of Bitcoin could have profound implications on the crypto market. As the leader of a company managing over $10.6 trillion in assets (approximately 3.8 times France’s GDP), his statements can influence large-scale investment decisions.

Expanded Context and Economic Implications

The embrace of Bitcoin by BlackRock, as well as other legacy firms like Fidelity, reassures boomer advisors and allows them to allocate. That’s why betting against these ETFs, or downplaying their early and obvious success to anyone with eyes and a brain, has been and will be stupid, in my opinion.

Eric Balchunas, ETF expert

Bitcoin should be part of every investor’s portfolio.

Larry Fink, BlackRock CEO

Fink’s declaration comes at a time when investors are seeking uncorrelated assets to diversify their portfolios. According to Fink, Bitcoin can offer non-correlated returns and financial control, especially during periods of economic fear. “It is an instrument in which you invest when you are more concerned,” he added. This perspective is particularly relevant in the current context of excessive deficits and currency devaluations by certain countries.