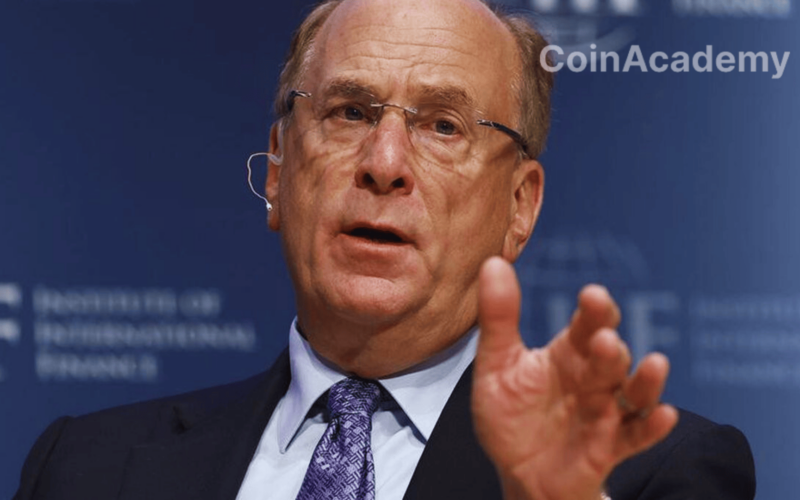

The iShares Bitcoin Trust, BlackRock’s Bitcoin ETF, has seen its assets under management increase by over 3,700%, surpassing 100,000 BTC since its launch on January 11, 2024.

Exceptional Performance and Record Investment Flows

According to official data from BlackRock, the iShares Bitcoin Trust (IBIT) held 105,280 BTC on February 13, becoming the first Bitcoin Spot ETF in the United States to reach this level of assets managed in just 22 days of trading, outpacing the nine other Bitcoin Spot ETFs, excluding Grayscale’s GBTC which has been in existence for a longer period in a different format.

Comparison with Other ETFs and Market Reaction

Unlike IBIT, the Grayscale Bitcoin Trust ETF (GBTC) has reduced its holdings by 25%, going from 619,220 BTC to 463,475 BTC since the historic launch of Bitcoin Spot ETFs in the United States. Fidelity’s ETF, the Wise Origin Bitcoin Fund (FBTC), has also experienced significant growth, accumulating 83,925 BTC as of February 13.

This milestone for IBIT comes amidst significant growth for Bitcoin, which surpassed $51,000 for the first time since November 2021, reaffirming its status as a trillion-dollar asset on February 14.