BlackRock Considers Approval of Potential Ethereum Fund

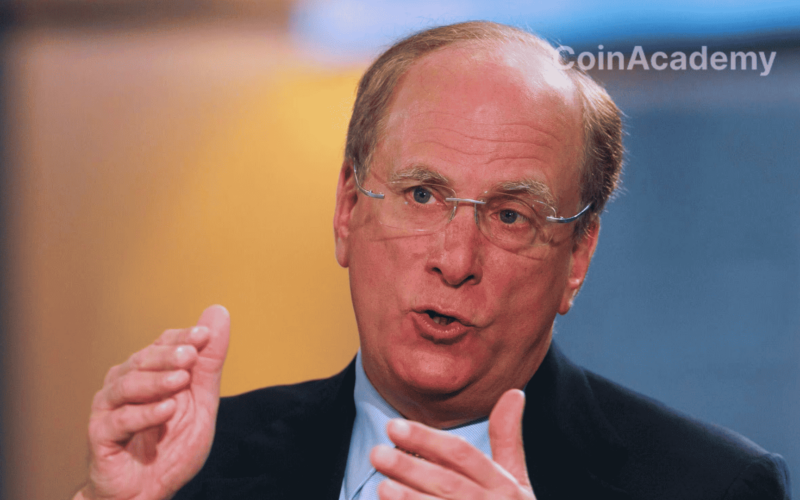

The CEO of BlackRock, Larry Fink, has shown interest in a potential Ethereum Spot ETF. This comes after the successful launch of the company’s Bitcoin spot ETF, called IBIT, which garnered a trading volume of $1.05 billion on its first day, surpassing expectations.

Interestingly, this performance exceeded the initial trading volume of the Bitcoin futures ETF, BITO, which was $1 billion upon its launch in 2021. Fink emphasized that these developments are ‘springboards to tokenization,’ as well as a significant evolution for cryptocurrencies as an asset class.

‘These are just springboards to tokenization, and I really believe that’s where we’re going.’

– BlackRock CEO

The BlackRock Ethereum Spot ETF

BlackRock filed for an Ethereum Spot ETF in November, following their request for a spot Bitcoin ETF in June.

For their Ethereum ETF, named ‘iShares Ethereum Trust,’ BlackRock has selected Coinbase Custody as its asset custodian. Bloomberg analyst Eric Balchunas estimates a 70% chance of approval for the Ethereum ETF, likely before May 2024.

Under Fink’s leadership, BlackRock has taken a proactive stance in cryptocurrency adoption, responding to the growing demand from their clients for cryptocurrency products.