Australia at a Crossroads in Regulation of Digital Assets

Australia finds itself at a crossroads when it comes to regulating digital assets. Recently, the Senate’s Economics Legislation Committee dismissed the ‘2023 Digital Assets Market Regulation Act’ proposed by opposition senator Andrew Bragg. This rejection highlights the government’s reluctance to accelerate cryptocurrency regulation, creating an atmosphere of uncertainty in the sector.

The government says it continues to consult the industry on the development of digital asset regulation that is suitable for Australia.

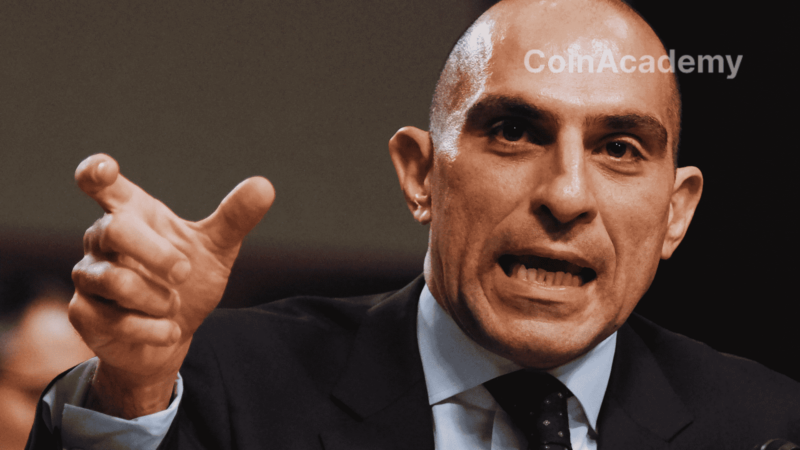

Australian Senate Committee

The committee emphasized the inconsistency of the bill with international regulatory frameworks, expressing concerns about potential regulatory conflicts and negative consequences on the industry. Bragg, representing New South Wales, criticized the ruling party for delaying crucial regulations for cryptocurrencies.

Delays and Additional Consultations

Despite the palpable anticipation surrounding the bill, the Senate committee identified a significant lack of detail and clarity in its clauses. This rejection reflects a broader hesitation to crystallize a position on digital asset regulation in Australia. Additionally, the government had already initiated a consultation paper in February under the auspices of Prime Minister Anthony Albanese, aiming to create a licensing framework for crypto asset service providers by mid-2023, an initiative that has not made notable progress yet.

In response to this delay, industry experts such as Michael Bacina, Chairman of Blockchain Australia and a lawyer specializing in digital assets, have stressed the need for the government to take into account feedback from the sector and rely on the contributions made during the Senate committee’s review of the bill.