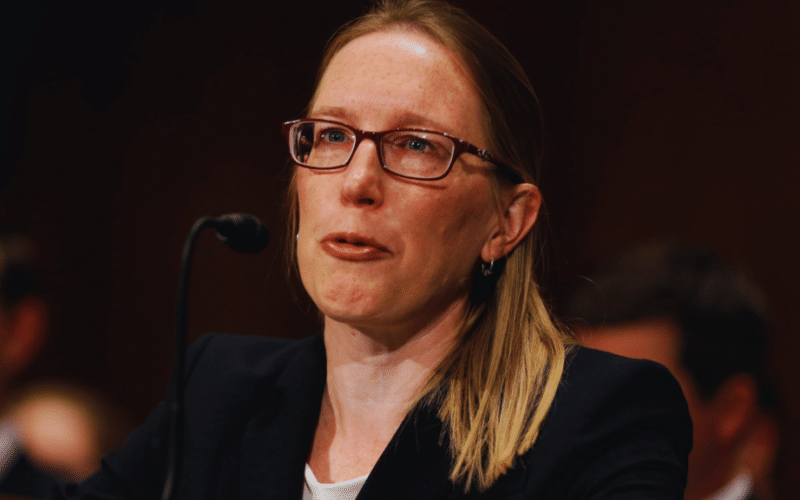

Hester Peirce Questions the Actions of the SEC:

- Hester Peirce criticizes the SEC’s approach to handling cryptocurrency cases.

- She questions the SEC’s prioritization of resources, suggesting a shift towards more traditional fraud cases.

- Peirce recommends a regulatory approach rather than a litigious one and calls for Congressional involvement.

Hester Peirce, commissioner of the U.S. Securities and Exchange Commission (SEC), expresses perplexity regarding her agency’s strategy in regulating cryptocurrencies. She raises concerns about the lack of consistency in how the SEC selects cryptocurrency companies to pursue legal actions against, citing an approach that appears to be “arbitrary and inefficient.”

She specifically highlights a 3% increase in SEC enforcement actions during the 2023 fiscal year, attributed to SEC Chairman Gary Gensler’s growing interest in the crypto ecosystem.

Peirce criticizes the arbitrary selection of cases handled by the SEC, suggesting a lack of logic or reasoning behind these decisions. A notable example is the action against NFT issuer Stoner Cats 2 LLC, where Peirce questions the SEC’s prioritization of resources, arguing they could be better used to address “traditional securities fraud.”

“I don’t really consider it my top goal to prevent people from buying Stoner Cats” – Hester Peirce ironically stated

Calling for More Coherent Regulation of Cryptocurrencies

Peirce emphasizes the importance of more effective and targeted regulation in the cryptocurrency space, suggesting tackling areas where the “real harm” is evident first.

She advocates for a regulatory-focused approach rather than a litigious one, criticizing the SEC’s tendency to fight battles in court. The case against LBRY, which led to the shutdown of their content-sharing platform, is cited as a particularly troubling example.

“It was a project that had actually built a functioning blockchain that was being used… and efforts were made to try to launch it in a way that was compliant with securities laws.“

– Peirce stated

Peirce calls for a more judicious allocation of resources and suggests that Congressional involvement could be beneficial in clarifying regulatory authority over cryptocurrencies.

This position contrasts with Gensler’s, who claims that cryptocurrency regulation is already clearly defined.