If you want to start investing in cryptocurrencies or simply deepen your understanding of this topic, this guide is made for you; no matter your trading experience and current understanding of cryptocurrencies.

There is no fool-proof technic to always make winning investments, but this guide aims at helping you get useful habits by sharing what I’ve learned in five years on the cryptocurrency market.

Before letting you know how to find gems, let me start with a few important introductory points.

Table of Contents

- Identify your type of trader or investor

- Combine technical and fundamental analyses

- Find cryptocurrency projects before investing

- The categories of cryptocurrency projects

- Layer 1 – Blockchains that enable the creation of tokens and smart contracts

- Layer 2 – Blockchains working on top of Layer 1

- Layer 0 – Blockchains that interconnect Layer 1’s

- Decentralized Finance (DeFi) projects

- Metaverse projects, Play to Earn and NFTs

- Zero Knowledge Proof (ZK) projects: scaling, security and transaction anonymity

- It is not up to us to find gems for you

- Conclusion

Identify your type of trader or investor

In my opinion, the number 1 rule to survive in this market is to enjoy yourself. In order to improve, you will need to spend vast amounts of time on the market, and it is therefore important to make it fun and identify what makes you like this activity.

If I take my personal example, I know that trading is not very satisfactory to me, i.e. constantly buying and selling cryptocurrencies; I much prefer making long-term investments on projects and visions that speak to me or have the ability to fulfill a need or solve a problem.

Everyone is different and, as said earlier, there is no ultimate technic to make money in this market. Many friends of mine enjoy trading and have good results without caring much about the underpinnings of a project, whereas others like to combine trading and investments.

It’s up to you to identify what you prefer doing!

Combine technical and fundamental analyses

Before we start, it is important to understand what technical and fundamental analyses are.

Please read our two articles on these topics if you haven’t heard of these notions before, and come back to this article afterward:

- What is technical analysis in trading 👉 Click here

- What is fundamental analysis 👉 Click here

Combining technical and fundamental analyses will give you a clear picture before investing in an asset. Indeed, you may invest in a project that has rock-solid fundamentals, but if it is overvalued according to many traders and investors, its price can go down strongly and for a long time. You will end up losing money and doubting the fundamentals of the project.

Personally, I wanted to focus solely on fundamental analysis when I started investing in cryptocurrencies, which was a mistake. If you can’t put yourself in the shoes of a trader or a whale, you will struggle with anticipating their reactions, which is why having solid technical abilities is important even if you tend to prefer fundamentals.

The reverse is true as well: if you only focus on technical analysis, you might get stuck with an asset that is not worth much in the eyes of the market, which could cost you a lot of money.

Find cryptocurrency projects before investing

To find good cryptocurrency projects, the first step is to find new projects. We all know that there are thousands of different cryptocurrencies and it is hard to know where to start, although starting somewhere is a mandatory step. Time to go for it!

Correctly identify and compare cryptocurrencies

You cannot know the ins and outs of all projects, but you can get an idea of many of them; I personally know almost all of the TOP 100 cryptocurrency projects. I don’t need to know everything about them, my goal is to have a clear overall picture of the top projects on offer on the market.

Why spend all this time getting to know these projects? Simply because this market is exciting, and I take great pleasure in trying to understand it; most importantly, it gives me comparison points to differentiate projects that have many similarities.

People tried for a long time to find the new Bitcoin, then the best Ethereum killer, i.e. a project that does what Ethereum does in a better way. For this, it is important to know what projects like Bitcoin and Ethereum do and don’t do, which is why knowing the fundamentals of these two projects is crucial before taking the plunge and trying to unearth gems.

Find projects

Finding projects is simple enough, they’re everywhere on social media: YouTube, Twitter, TikTok, Discord, Telegram… You just have to follow these media or personalities who specialize in cryptocurrencies to learn about a project. It is what most of us do and there is nothing wrong with this; make sure that once you hear about a project, you take the time to analyze it before making an investment decision.

Here at CoinAcademy, we strive to produce complete analyses on a variety of projects to help you make an opinion on them. You can find these analyses here.

Click on a project on this page to read the complete analysis as well as a summary of the project in question. This doesn’t prevent you from doing your research but it will give you a good starting point to learn about the most important cryptocurrencies. I think it is the best way to go for beginners.

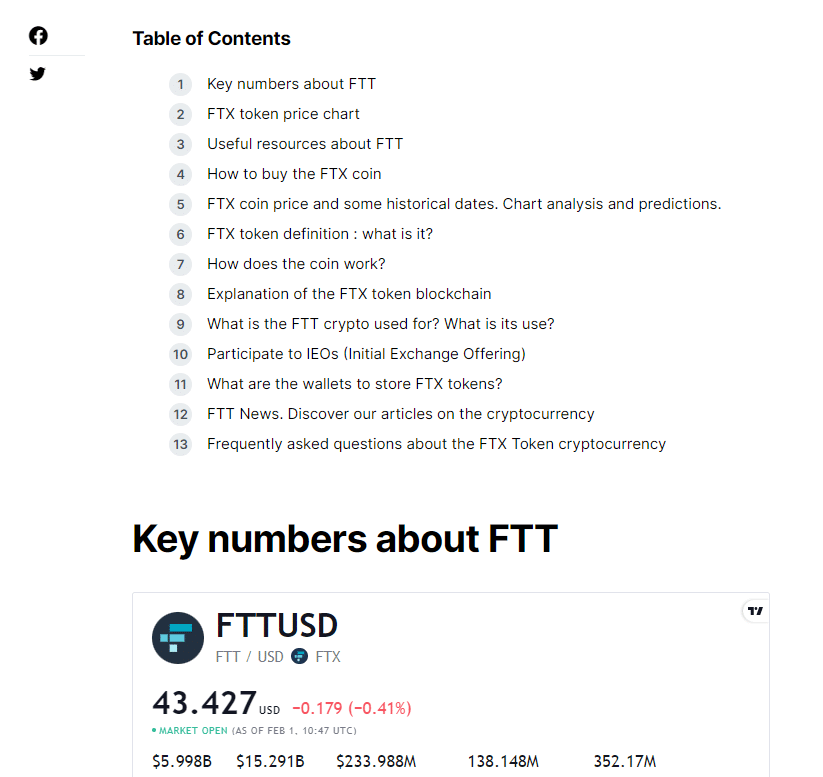

Here’s an example with the FTX token project (FTT):

To find projects, follow the Twitter or Telegram accounts of cryptocurrency projects; you may also follow their official Discord servers. You will meet great people but be ware of scammers, stay vigilant or even slightly paranoid, there is nothing wrong with that.

You can also simply read and cross reference the information you find with other sources (websites YouTube videos, articles, etc.).

The categories of cryptocurrency projects

In order to know whether a project is suitable for an investment, you will need to spend time analyzing it, which is why I would advise that you specialize in a domain. There are many different sectors in crypto and you will not be able to gain an expertise in every one of them; identify the elements you most enjoy and the ones you understand the most thoroughly.

If you are only getting started on you cryptocurrency journey, it may be interesting to gain some knowledge about the TOP 5 crypto projects of each category and understand how they reached this level.

Here are examples of cryptocurrency categories that I deem important:

Layer 1 – Blockchains that enable the creation of tokens and smart contracts

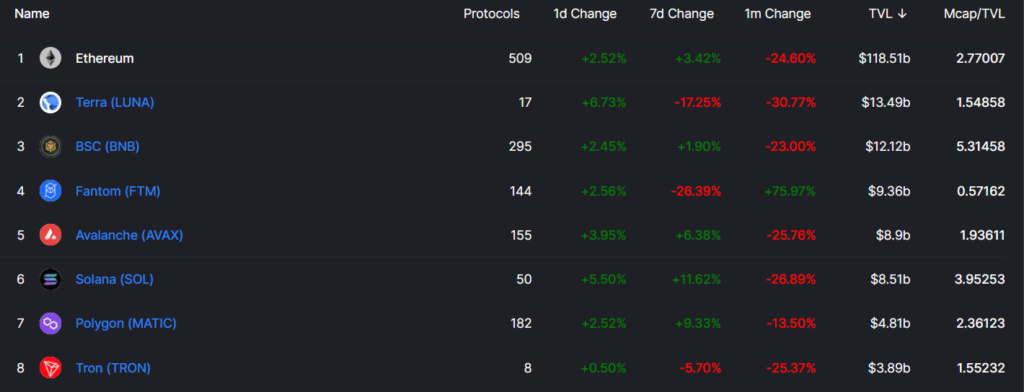

Layer 1 simply means the following: main layer or level 1 layer. Bitcoin as well as Ethereum are Layer 1 cryptocurrencies. Serious contestants of Ethereum are numerous, competition is fierce, and it is interesting to know why these competitors exist in such large numbers.

Ethereum is often blamed for offering expensive transactions combined with a rather slow network, and the market therefore has an interest in faster blockchains with minimal transaction fees such as Solana and Fantom when it comes to creating new tokens and decentralized applications in the form of smart contracts.

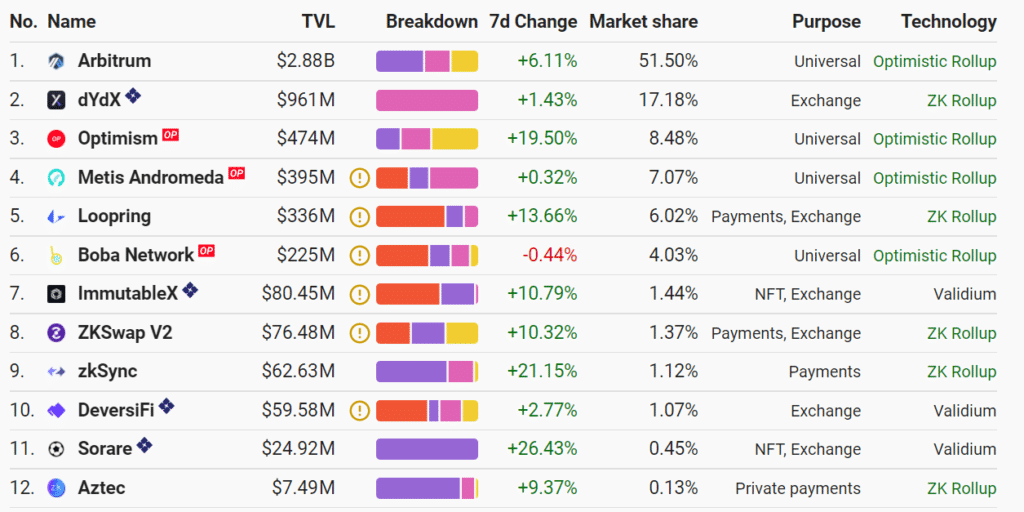

Layer 2 – Blockchains working on top of Layer 1

There are many so-called Layer 2 projects (second layer), which are platforms that help Layer 1 projects scale. Each blockchain can manage a given transaction number for a given cost, and Layer 2 blockchains generally benefit from the security of Layer 1 while offering faster transactions for a much lower cost in case Layer 1 is not capable of fulfilling the whole demand.

Layer 0 – Blockchains that interconnect Layer 1’s

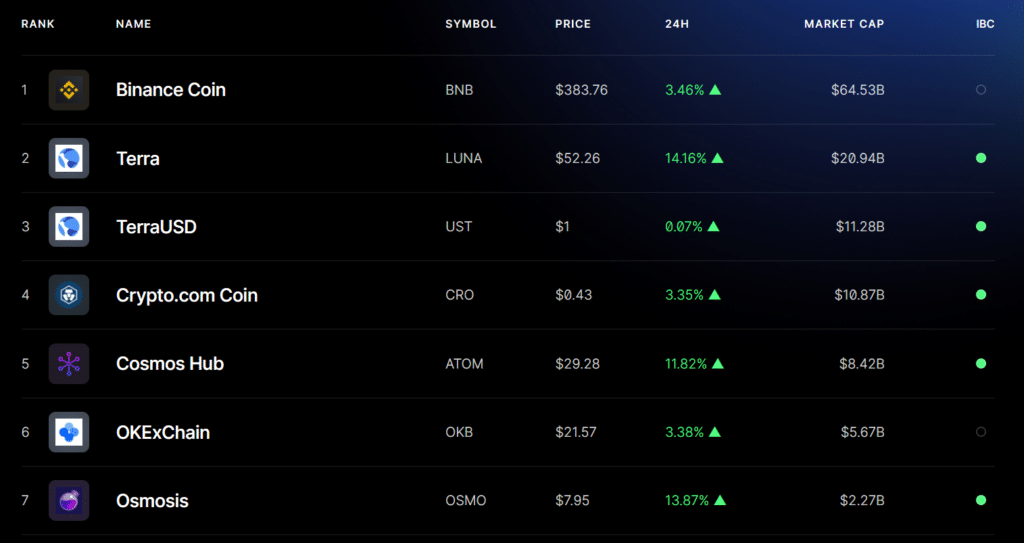

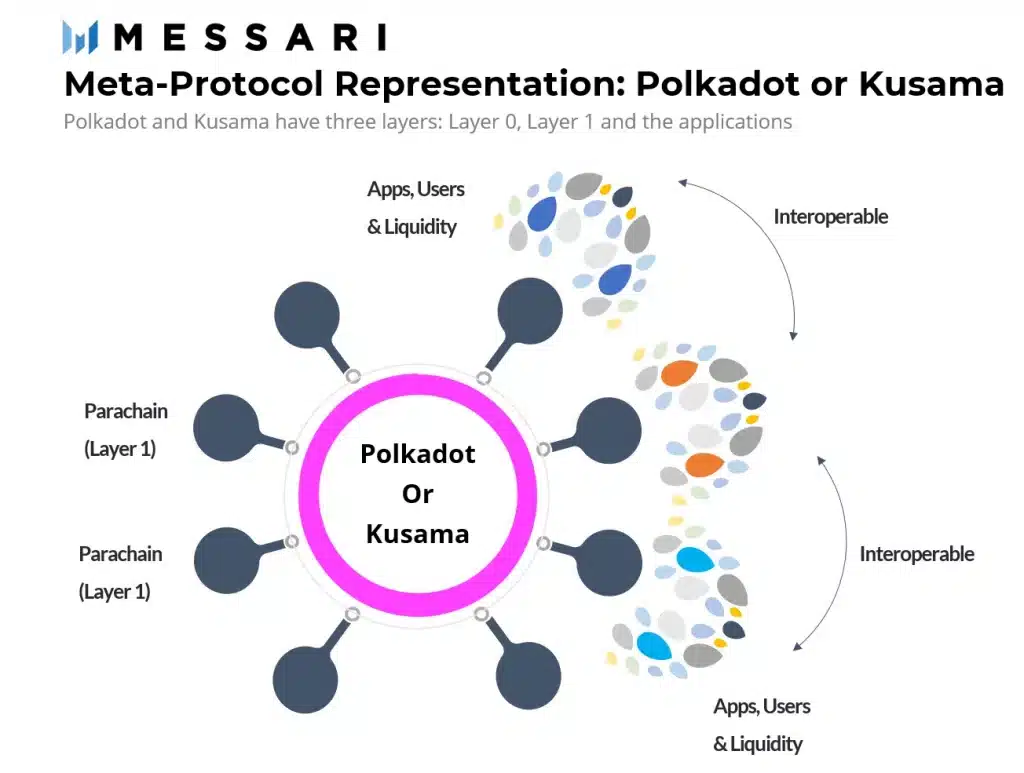

The most important Layer 0 projects are Polkadot, Kusama and Cosmos Network. These three blockchains are at the core of hundreds of different projects, so there is a lot to work with if you wish to know more about new cryptocurrencies.

For you to better understand notions of layers 0, 1, and 2, here’s a picture from Messari. We can see that Polkadot or Kusama are placed at Layer 0, the layer that comes BEFORE Layer 1. Then we see the different Parachains, which can be roughly defined as blockchains that allow for the creation of cryptocurrencies and smart contracts.

The projects that will be created on top of Layer 1 are Layer 2 projects; we can even go further and say that if applications are created on top of Layer 2, these are Layer 3 projects and expand this logic indefinitely.

One last analogy in case the notion isn’t clear yet: when you switch on your computer (Layer 0), Windows starts on it (Layer 1); in Windows you then open the Google Chrome web browser (Layer 2), and in this browser you launch a video game or application (Layer 3).

Decentralized Finance (DeFi) projects

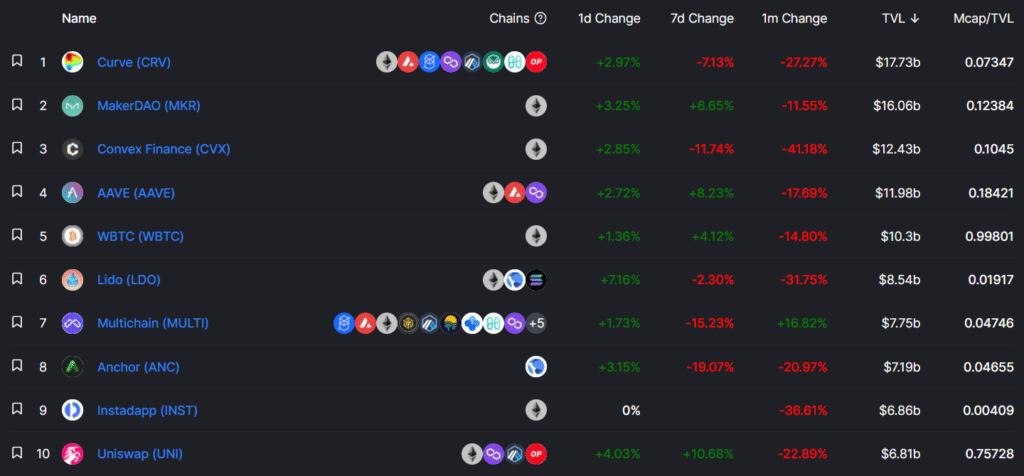

Decentralized finance saw the light of day during the 2017 bullrun thanks to Ethereum; at the start, the strength of Ethereum mainly resided in the ease it gave to create new tokens without having to create one’s own blockchain.

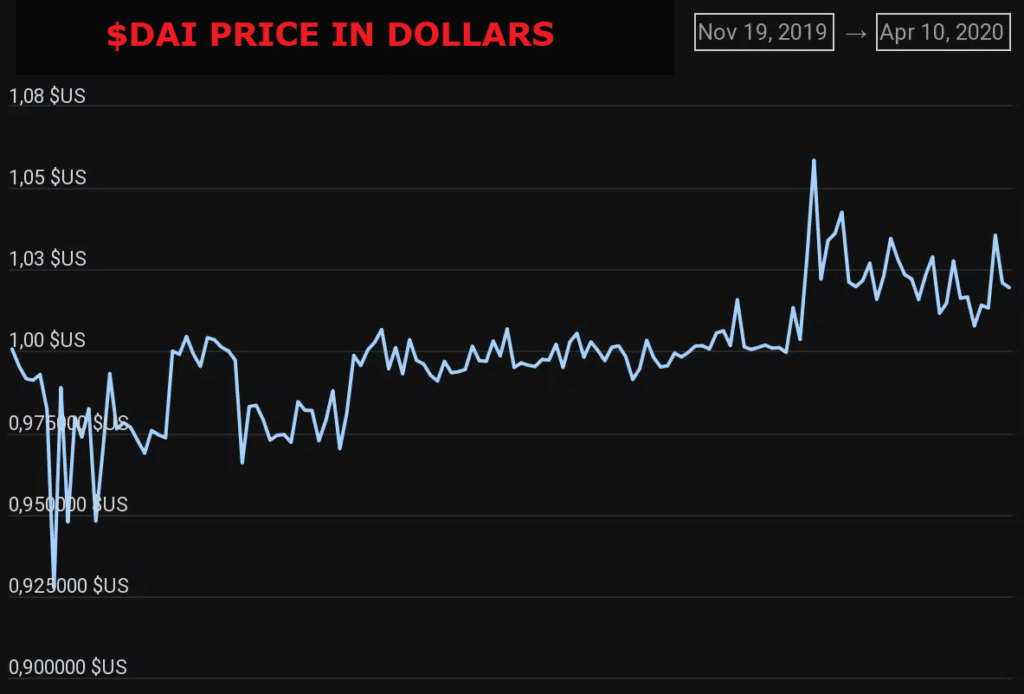

We saw the dawn of the first DeFi protocols such as Bancor, an ancestor of Uniswap, and MakerDAO, a decentralized DAI stablecoin project indexed on the dollar, which we could consider to be an ancestor of Terra Luna but also ETHLend that since became AAVE, and allows people to lend money and earn interests like a bank, directly on the blockchain.

Back then, in 2017, these projects struggled to go mainstream because they had flaws, the first of which being that people didn’t understand their usefulness, and in the case of $DAI the product was not perfectly stable; we expect for a stablecoin indexed on the dollar to maintain its price at $1 at all times and, well, see for yourself:

Later on, after several years of bear market, the market continued to expand and new DeFi projects were introduced, such as Uniswap (UNI) and Sushiswap (SUSHI) that allow to exchange different tokens without going through a decentralized exchange. AAVE and MakerDAO (MKR) managed to survive unlike many other projects that ended up disappearing, which is why it is important to specialize and keep an eye on these projects and their competitors.

Metaverse projects, Play to Earn and NFTs

More than a simple trend, Metaverse (virtual worlds), Play to Earn, and NFT projects have a bright future ahead of them, I am personally convinced of this as a gamer and nerd who has been in front of a screen since I’ve known how to stand on my two feet.

Many projects are launched in these sectors and it is not always easy to identify the most serious ones, hence the need to research the market thoroughly; speculating on these projects remains dangerous at the moment, but I’m sure the market will gain in maturity in the years to come!

Zero Knowledge Proof (ZK) projects: scaling, security and transaction anonymity

This is the category I am the least knowledgeable about, cryptocurrency projects that involve a zero-knowledge proof. There exist different Layer 1 and Layer 2 projects that use this technology today. It is not easy to understand but may be worth digging into as it has the potential to solve many problems faced by the blockchain technology.

We will be sure to provide you with articles focused on this topic in 2022.

It is not up to us to find gems for you

Here at CoinAcademy, we analyze projects and give you our opinion but it does not prevent you from cross referencing information and dig deeper on your end.

When you invest in a cryptocurrency you generally invest in a vision, a team, a marketing scheme, technical support and a community. It is therefore crucial to learn how to take every investment very seriously because if you don’t, you may find yourself overwhelmed. It is never too soon to get good habits: be a serious investor.

Obviously, there is a luck component in every investment but doing your homework consistently will give you the best odds possible.

Conclusion

I presented quite a lot of notions in this article in the goal of steering you in a direction that I find to be a good starting point: understanding Bitcoin and Ethereum as well as the main projects of each category, and identifying projects that have them beaten in virtually all areas.

While I was writing this, I realized that a single article would not suffice as we still haven’t learned how to analyze a project. We also didn’t go into the topic of reacting to a market movement in the goal of preserving your capital. Indeed, investing against a market trend can cost a lot of money, and it is not easy to identify this trend when getting started on the crypto market.

Everyone cannot enter a project long before the rest, it is not easy to be part of the first wave and not sell too early or too late; to be perfectly honest, it is almost impossible.

Rest assured, stories of the like of “if you’d bought Bitcoin when it was at $10 you would have multiplied your capital by 4,000” are virtually non-existent in reality; keep your goals realistic and grow your capital as much as you can. This article will soon be updated with a link to the following guide: Analyze a cryptocurrency project correctly before investing.