Leverage is an essential element of the crypto ecosystem, but it remains largely unknown and little used when it comes to yield farming. This article aims at popularizing and providing a deeper understanding of leveraged yield farming.

As a reminder, yield farming means locking assets on a platform to bring liquidity. In return, the platform rewards the liquidity providers with their native tokens.

There are two main ways to take part in yield farming:

- Lend cryptocurrencies

- Borrow cryptocurrencies

Table of Contents

Lending

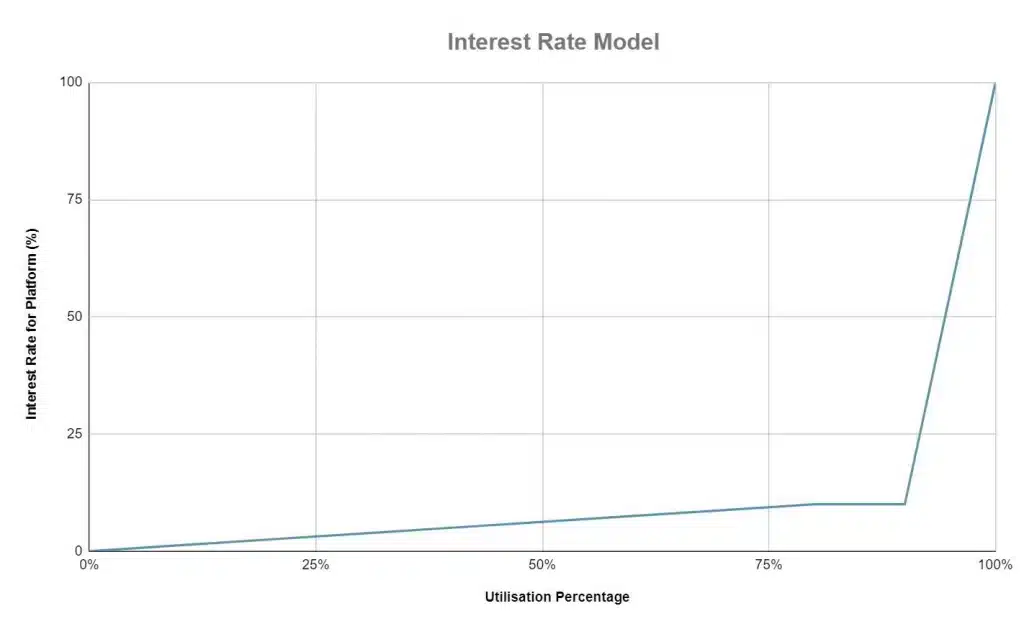

Lending means that the participant is depositing assets on a platform for other users to borrow. In return, the protocol rewards the participant with an APR (Annualized Percentage Rate) that depends on the usage of the lending pool (the higher the demand for liquidity, the higher the APR in order to attract lenders). This is a good sign for lenders but a bad sign for borrowers who will need to pay higher rates to borrow assets.

Generally speaking, this is a wise investment as the interest rates are often very attractive in comparison to the risk.

Borrowing

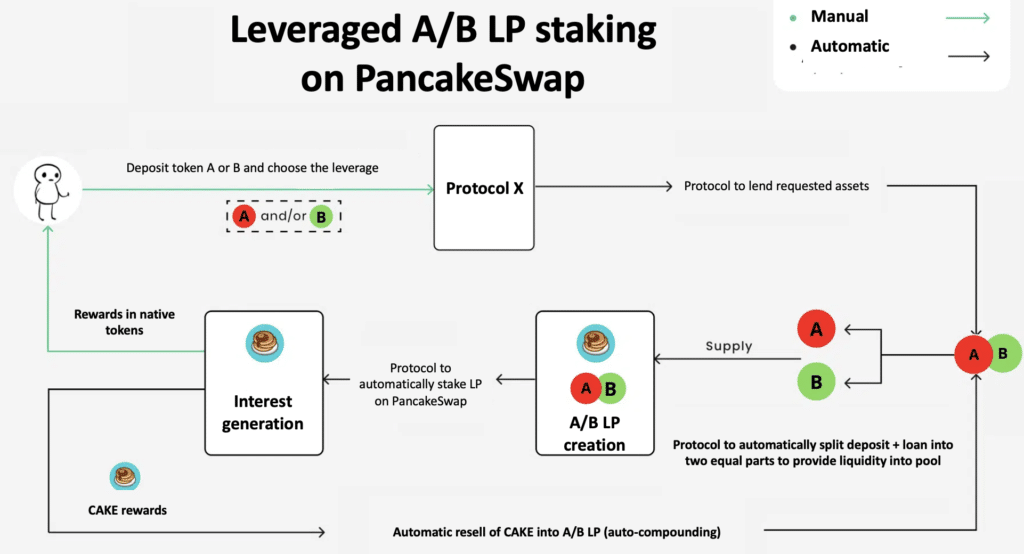

Borrowing will enable a participant to borrow more assets to stake more and increase the interests and hence the APR.

The protocol is thus an intermediary that rewards the participant in 3 ways:

- Yield farming rewards (increased through leverage)

- Transaction fees

- Native tokens

Money management strategies

Stablecoins

The strategy requires a large deposit of stablecoins with a high leverage to enhance yield. To simplify, if I deposit $1,000 with a 5x leverage in a USDT – BUSD liquidity pool, I will effectively be depositing 2,500 USDT + 2,500 BUSD in the liquidity pool and the APR will be 5 times as high in comparison to the initial $1,000 deposit (not taking the borrowing interest rates into consideration).

As a reminder, in farming, one needs to deposit the same amount of 2 different assets in a liquidity pool. In our example, we started off with a $1,000 (1,000 USDT) deposit that we multiplied by 5 due to the 5x leverage. This means a total amount of $5,000. This is why we end up with 2,500 USDT and 2,500 BUSD as these two assets have the same price.

Hold

The strategy entails staking a long-term token in combination with a stablecoin at a 2x leverage so that the chosen token fluctuates while earning interest rates. However, one should consider the Impermanent Loss (loss due to the volatility of the assets in the pool) that can alter your initial deposits, especially when using high leverages. To anticipate the Impermanent Loss due to the market fluctuations, one can simulate various scenarios on this simulator.

Short / Long

Through a larger leverage exposure (at least 2x), one can accumulate a short and a long position on each token of the liquidity pool while benefiting from yield farming. Specifically, this involves borrowing a token with a leverage higher than 2 for the short position (betting on a price drop), naturally leading to a long position for the other token.

For example, if I want to farm on the ETH-BNB pool and the market believes in an ETH pump but not in a BNB pump, one needs to deposit $5,000 worth of ETH with a high leverage (e.g., 4x) to have an LP token made out of $10,000 worth of ETH and $10,000 worth of BNB.

In this specific example, we borrowed $15,000 worth of BNB to swap $5,000 worth of BNB for ETH to create a balanced 50/50 pair with 50% BNB and 50% ETH. ETH will be in a 2x long position (leverage 4/2x) and BNB in a 2x short position (meaning price variations twice as high).

For those with a long-term vision on several tokens, this might be a good strategy, considering that one can short or long only one token of a pool using stablecoin / crypto or crypto / stablecoin pools while benefiting from rather high APRs.

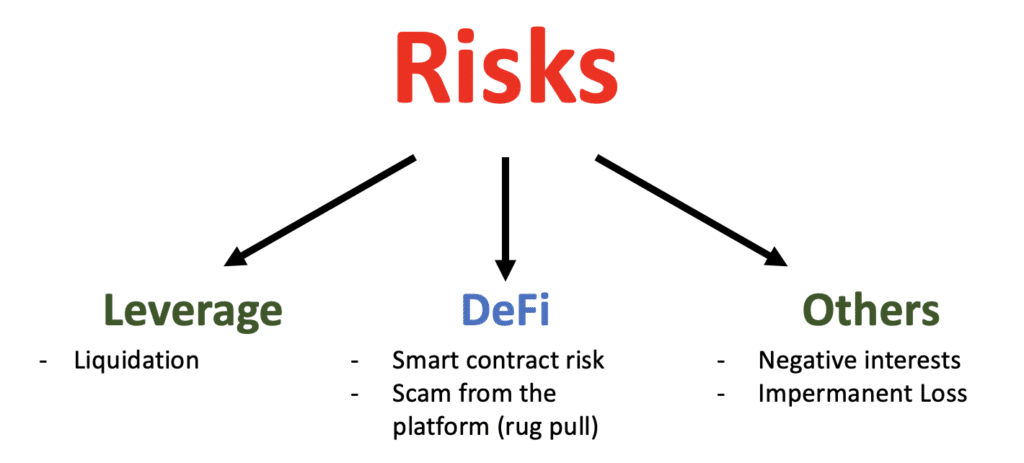

Risks

Excluding Impermanent Loss (IL), the main risk is liquidation. Indeed, using leverage enables one to increase one’s exposure for higher interests, but also means increasing risks of losses if the liquidity pool undergoes high volatility. As a reminder, liquidation is a process in which a position is closed because of the loss of the entire or almost entire initial margin, meaning the debt ratio went above 100% (debt/total position).

Another risk is that of interest rates. As the borrowing interest rate varies, one needs to check every now and then that the interest rate has not gone up too significantly so that one does not have to repay more than what you earn through yield farming. These different risks must be seriously taken into consideration when investing, based on one’s money management.

Finally, just like on any DeFi project, there is the inherent but unfortunately unforeseeable risk of a safety issue (smart contract risk). This is why investment diversification is of utmost importance.

Platforms

There are currently several platforms to do lending and borrowing.

The most well-known one on the Ethereum network is Alpha finance while Alpaca finance is the leader on the Binance Smart Chain with a Total Value Locked (TVL) of over $1.5 billion. Another lesser-known platform with a lot of potential is Kalmar finance.

As far as other networks such as Avax or Matic are concerned, Eleven finance offers attractive APRs. There is also Tarot on Fantom, a growing protocol that offers up to 100% return per year on stablecoins. Finally, on the currently trending blockchain Solana, Tulip (previously SolFarm) offers leveraged yield farming.