Solana is a blockchain launched in March 2020 that managed to make a prestigious name for itself within the crypto universe over the year 2021. As of today, the 7th cryptocurrency in terms of capitalization is one of the most successful and efficient blockchains due to its technological innovations.

Its Proof-of-Stake consensus protocol coupled with the innovative transaction time-stamping system allows this blockchain to increase its scalability tenfold, reaching 65,000 transactions per second. The propulsion of its SOL token to the center of the crypto scene has highlighted some of Solana’s particularities regarding its true decentralization.

Table of Contents

- “The Ethereum Killer,” how the Solana blockchain is taking over the crypto ecosystem

- The Proof-of-History explained

- The Solana Foundation, too central an actor in its blockchain?

- The constraints related to the Solana validation protocol

- The distribution of SOL tokens

- Decentralization, a technological challenge.

- Solana, a “centralized” blockchain with many projects and ambitions

- Conclusion

“The Ethereum Killer,” how the Solana blockchain is taking over the crypto ecosystem

The Solana project tends to compete with Ethereum, the leading blockchain in terms of usage and the second-highest valuation in the cryptocurrency market. The goal of the Solana Foundation is to implement a blockchain that facilitates the development of Web3 applications and DeFi infrastructure.

The performance of its cryptocurrency, its DeFi ecosystem, and its NFT collections have demonstrated the potential that the Solana blockchain and its ecosystem have. Its scalability represents its main asset, transaction fees are very low, $0.00025 on average. In contrast to the Ethereum blockchain, which highlights the limitations of low scalability.

The Proof-of-History explained

Its consensus algorithm is particularly innovative, combining the Proof-of-Stake with a time-stamping mechanism called the Proof-of-History. PoH is a time-stamping mechanism that improves the validation time of a block, adding a function to the hash, a crucial time data for good coordination of the network nodes. Transactions are validated once they have met a time requirement. The PoH guarantees a fast transaction speed and a more efficient and secure decentralization of the network by “synchronizing” it.

The Proof-of-History is therefore an additional temporal data (the countdown) added to the hashes, allowing better coordination of the nodes for the validation of transactions and thus better scalability. This data allows nodes to transmit proofs more efficiently between validators and to prevent double-spending, thanks to the time data provided by this system.

This revolutionary mechanism gives Solana the ability to transform consensus algorithms on blockchains. From now on, thanks to Proof-of-History, a transaction does not need to cross the entire network to find a validator, because they will be synchronized by this decentralized cryptographic clock. This is a form of shortcut, allowing better communication between the nodes and therefore have faster transactions.

Another advantage is that the verification of the proofs is parallelizable, i.e. the proofs are cut into several pieces, each processed by a CPU core (server processor). This time-stamping system intervenes before the consensus of the validators, which makes it possible to process a large quantity of data in a short time. While Solana demonstrates its capabilities and ambitions, criticism of its centralization and dependence on its Foundation may hinder its development process.

The Solana Foundation, too central an actor in its blockchain?

The technological revolution of blockchain and crypto-assets is inherently built in a decentralized system. Coming from the crypto-anarchist trend, these innovations aim to eliminate trusted third parties such as banks, states, or other centralized institutions which lose the trust of individuals as society becomes more individualized.

Decentralization is therefore the keystone of the Internet 3.0, but the Solana ecosystem raises some questions about its centralization. The dependence of the network on the Solana Foundation for the validation protocol and the allocation of tokens are some serious problems in a crypto universe where decentralization is the major driver.

Nakamoto’s coefficient is a tool for measuring the decentralization of a blockchain. Although it remains an approximate evaluation tool, it is nevertheless an interesting indicator. If a blockchain is not decentralized, then its validators could corrupt the process and carry out an attack on the network. Decentralization represents the convergence of individual interests that ensures the security of a blockchain.

While Solana reaches the paradoxically high score of 19, many questions about centralization are raised in some studies.

The constraints related to the Solana validation protocol

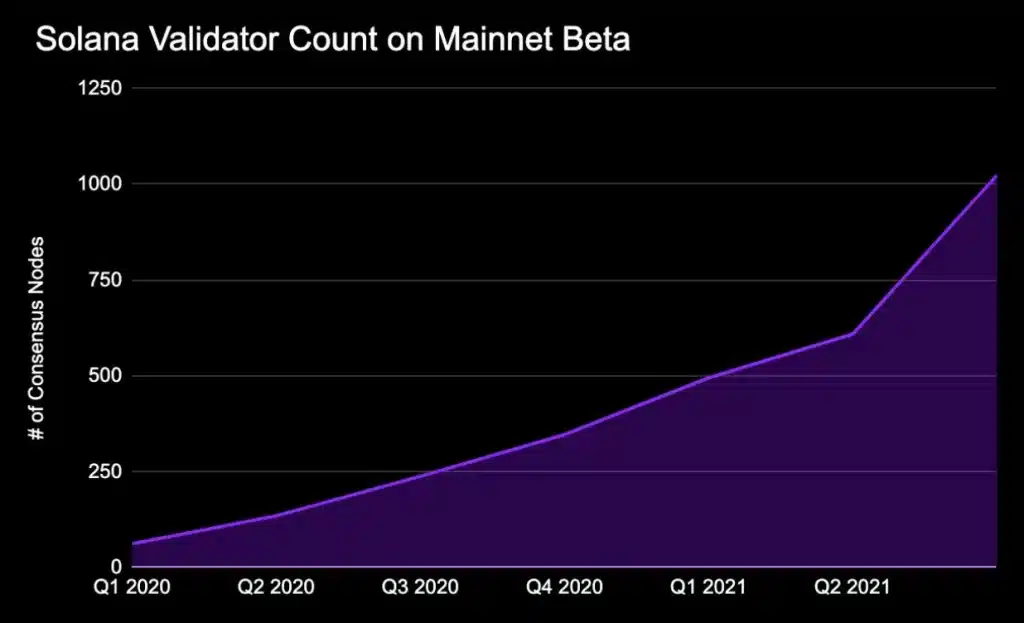

The criticism related to the “centralization” of the Solana network resides in part in its validation system, which requires significant computing power and therefore costly hardware. If its blockchain has great scalability, (65,000 transactions per second) it also has a high volume of throughput which imposes hardware challenges. The price of the required equipment is particularly expensive and represents the first form of inequality. The Solana network poses numerous constraints that encourage the centralization of the network and of its validators.

For example, Solana Labs recommends that validators use a 12-core processor with 128GB of RAM, which is very expensive, especially since the break-even point when running a validation node requires significant upfront funding.

In addition to hardware and network costs, you must pay a voting fee. These amount to about 1 SOL per day (in our observation, they are currently about 0.75 SOL per day, but expect 1 SOL per day). Validators are currently running on version 1.7 of the Solana program since October 2021.

“The reduction in voting fees is expected to start in version 1.9, but that probably won’t happen until early 2022, and we don’t know how significant that reduction will be.” Source Medium: Running a Solana Validators.

Quick calculations: 1 SOL ($200) x 30.5 = $6100 / month, plus the cost of the hardware exceeding $5000 to become a validating node on the network. It is easy to understand that becoming a node is not affordable for everyone.

The distribution of SOL tokens

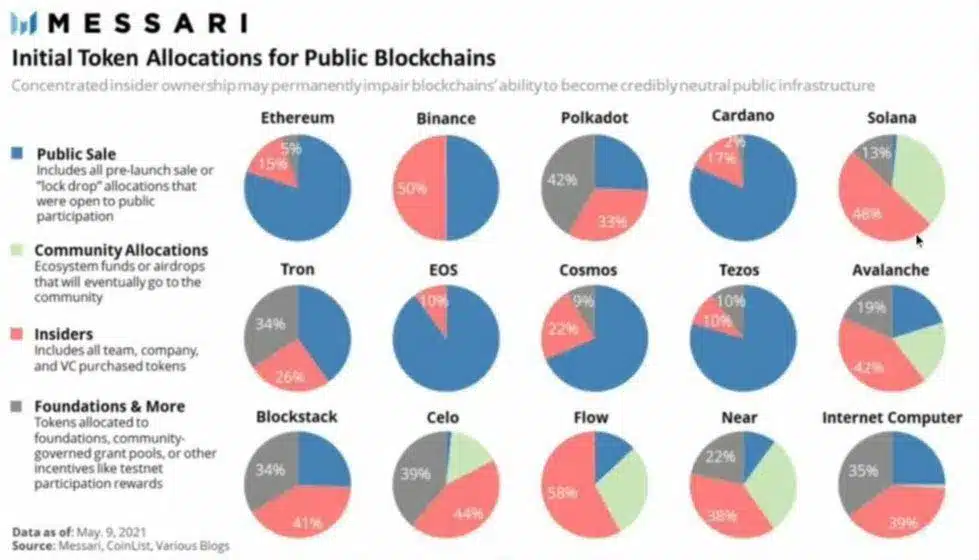

Messari Research Hub is a startup that aims to increase transparency in the crypto universe, which is potentially the leading analytics platform in the crypto industry. Known for its high-quality, large-scale research based on blockchain transaction data analysis. On May 9, 2022, Messari provided a report on the initial distribution of public blockchain tokens.

This report shows the high concentration of SOL tokens by “insiders”, those members of the Solana company. A high concentration of tokens is highly criticizable and not very reassuring, yet this report published on May 9, 2021, did not prevent the SOL token from breaking new records and propelling itself into the Top 7 cryptocurrency at the beginning of the year 2021. As the distribution of tokens is crucial to the decentralized and equitable distribution of power on the blockchain, the Binance Coin (BNB) is also targeted by these critics.

Compared to two other important Layer-1 protocols such as Ethereum or Cardano, insiders hold only 15% and 17% of the total supply. It is clear that Solana concentrates a very large share of its tokens within the project team itself. If these tokens serve as the network’s validation power, the small number of tokens allocated to the public could cause trust issues regarding its effective decentralization.

Decentralization, a technological challenge.

The technical problems of centralization

The Solana network recently experienced a major outage lasting 18 hours. While an IDO (Initial DEX Offering) suffered a bot attack, the validators got desynchronized and caused the network to crash. If Solana’s solution was to gather 80% of the validators on the Discord network in order to restart the blockchain, this demonstrates a harmful centralization. Because this crash was successfully resolved through a simple chat, it is important to understand that the centralization of the validation power of the nodes is the Achilles heel of the network. A similar attack has already occurred in December 2020.

Aleph.im and the first steps towards decentralization

Aleph.im is a cloud platform that allows for customized indexing solutions. It allows DEXs [decentralized exchanges] on Solana to provide their users with data on a token exchange, liquidity provision, token prices, and total volume of trading pairs. It offers a decentralized solution that would rival traditional centralized cloud computing. As an actor of Solana’s decentralization, Aleph.im collaborates with projects such as TheGraph (GRT) and is able to offer efficient and decentralized computing power to manage all indexing. These tools will allow the implementation of a decentralized system on Solana.

Solana, a “centralized” blockchain with many projects and ambitions

If Solana’s decentralization is far from being achieved, we can see that DeFi and NFT projects are multiplying there, like the Serum protocol or the DegenApe collection. Coupled with the active and effective communication of Solana Labs’ CEO, Anatoly Yakovenko, and the performance of its crypto-asset, trust in this blockchain does not seem to be impacted. Its ecosystem is growing steadily and relies on the influence of many important players in the cryptocurrency universe. But this marketing strategy, although effective as demonstrated by the SOL price, accentuates the centralization of this network around its founders.

While the problems of the Solana network raise fundamental questions about its development and the trust it deserves, it continues to grow and allow many ambitious projects to be created. The initial centralization of this cryptocurrency would possibly meet the financial and technological requirements needed to run the network efficiently and absorb large amounts of data on its layer 1.

But it is essential for this blockchain to emancipate itself from the Solana Foundation because eventually, the cost of running a validator must decrease. The popularity of Solana will potentially cause this decentralization, as its large and growing demand will balance the distribution of tokens.

Conclusion

The Solana blockchain and its token SOL have great days ahead of them, its technical performance and its growing ecosystem make this network a major player in the crypto universe and the decentralization project that accompanies it. It is only in its early stages of development, the success of the project lies in the real willingness of developers to decentralize this blockchain. If the active presence of its CEO on the networks tends to make us think that the Solana Foundation remains closely linked to the functioning of its blockchain and its adoption, the decentralizing phenomenon will necessarily be beneficial and essential to compete with Ethereum and the new Web 3.0 actors.

Sources