Definition of compound interest

Compound interest is the interest on a loan or deposit that takes into account both the original principal and the accumulated interest from previous periods.

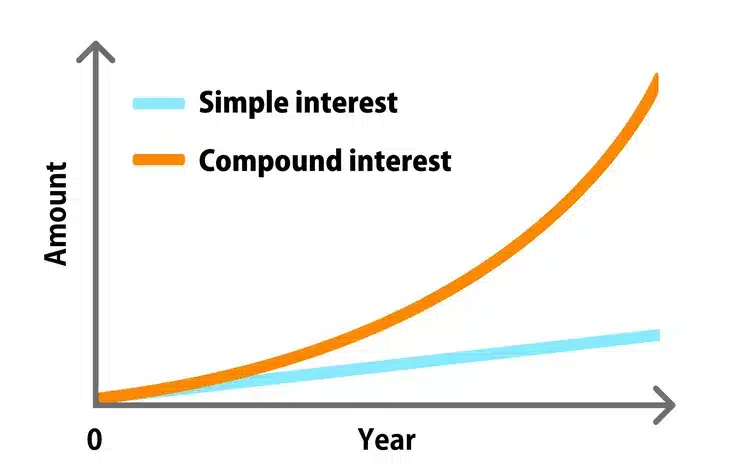

Compound interest can be represented as “interest generated by interest“. It grows faster than simple interest, which is calculated only on the initial amount.

Interest can be compounded at any frequency: continuous, daily, weekly or annually. The higher the compounding frequency, the greater the difference with simple interest.

The power of compound interest

Compounding allows you to go from constant linear growth to exponential growth. Time plays an important role, the longer the compounded investment, the more it diverges from the investment without compounding.

Compound interest is considered a strength and an essential tool for investors seeking to optimize the allocation of their income or wealth.

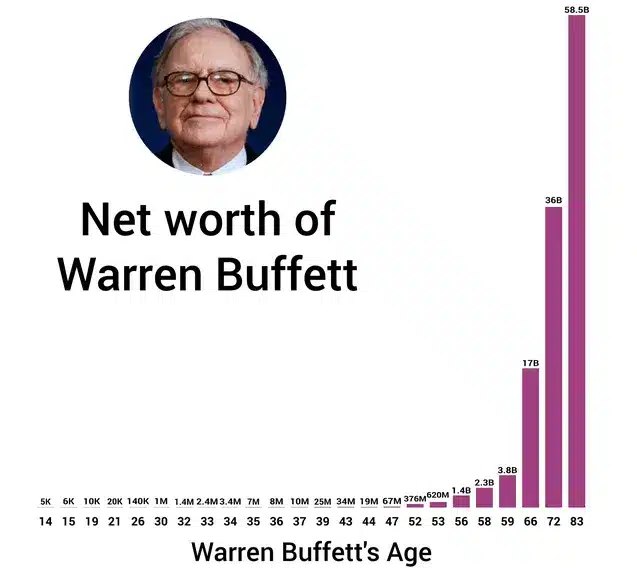

Warren Buffett became one of the richest people in the world through a strategy of patiently compounding his investment returns over long periods.

Compound interest is a process based on a long-term vision. Significant results will only be visible after some time.

This is why Warren Buffett realized most of his net worth after the age of 60.

What does this mean in practice?

Imagine being able to fold a sheet of paper 42 times over. Ask yourself how thick it would be?

The human mind is accustomed to thinking in a linear way and has difficulty in interpreting this issue. This same linear thinking limits our understanding and representation of the real power of compound interest.

In reality, the thickness of the folding would be equal to the distance between the Earth the Moon and represents all the strength of compound interest. Starting from the thickness of a simple sheet of paper of 0.1 mm, up to a distance of several hundred thousand kilometers (384 000 km) in only 42 folds.

Source: Quora

Compound interest calculation

The rate at which compound interest accumulates depends on the frequency of compounding. The greater the number of compounding periods, the greater the compound interest.

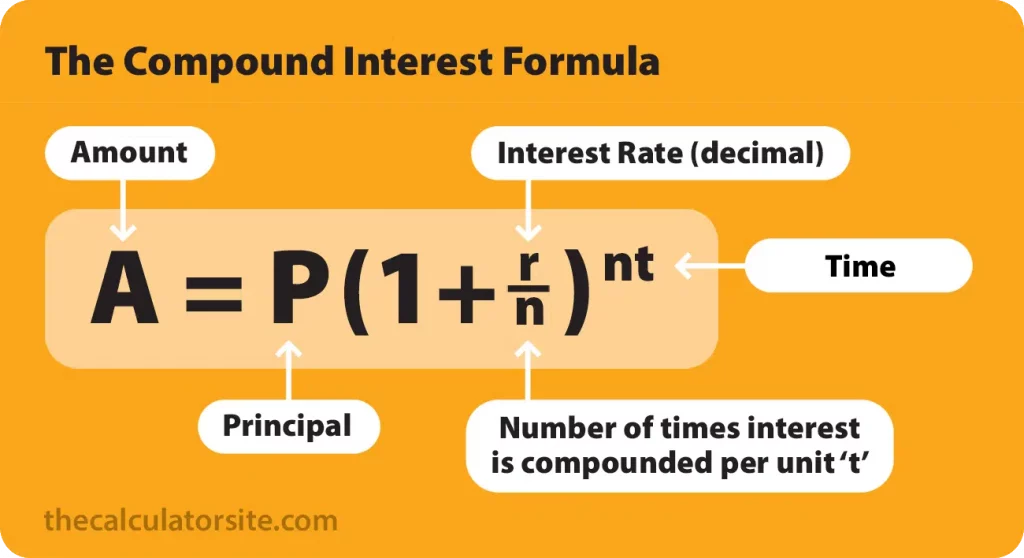

The formula for calculating compound interest is as follows:

With:

- A: The final result

- P: The initial investment

- r: The interest rate(0.1 for a rate of 10%)

- n: The number of times the interest is compounded

- t: The investment time

Exemple:

Let’s take an initial investment of $1000, compounded monthly at an annual rate of 12% for five years.

With compound interest, we have :

A = 1000 (1 + 0.12 / 12) (12 * 5) = $1816.70

Without compound interest, we get :

A = 1000 (1 + 0.12 * 5)= $1600

If you compound the interest monthly, you get a value difference of 216.70 €.

This difference is even more prominent in the cryptocurrency and DeFi ecosystem where the interest can reach triple digits.

APY vs APR in DeFi

In the cryptocurrency ecosystem, returns and interest govern and are central to all DeFi protocols. The terms APY and APR are often confused by users.

However, this difference has an important influence on your portfolio, because interest works linearly on one side and exponentially on the other.

The APY takes into account the compound interest that is fed back into the protocol to generate additional interest.

The APR does not take into account compound interest.

The more frequently interest is compounded, the greater the difference between APY and APR.

Most protocols promote their APY, in order to show higher percentages. However, in most cases, you have to compound the interest yourself to achieve these percentages.

There are protocols in DeFi allowing to automatically compose the proposed interests, in order to optimize the “gas” fees, it is the case of Beefy Finance for example.

Conclusion

Today, the interests govern the different protocols of DeFi, where each user is looking for the best rate to fructify his investments.

Understanding exactly how they work is a significant advantage in taking advantage of them and an essential asset in changing our financial perspectives.