What is called a “bear market” is a period during which the trend of a market is downward (by its price), in decline for a very long time.

In general, a bear market occurs after an irrational price rise that is accompanied by very heavy buying volume. As long as the price of a market fails to break major resistance while continuing to break support, it remains in a bear market.

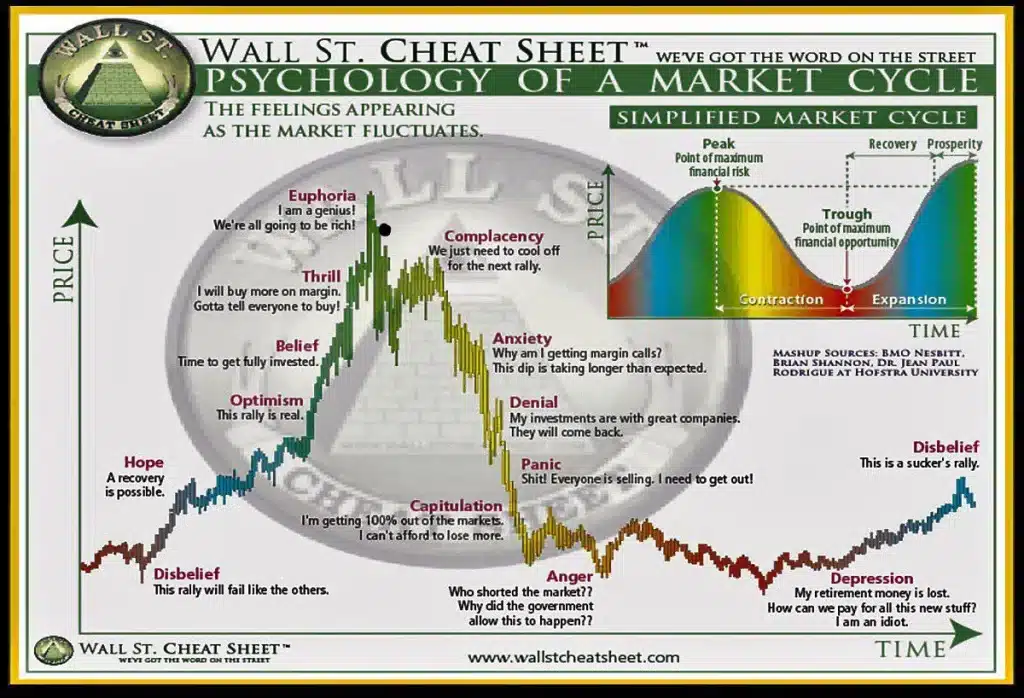

Bear markets are known to be extremely violent and difficult to trade, especially for an inexperienced investor. This is because of the overall market sentiment, where indecision and fear prevail among investors who are trained to wait for prices to decline to the bottom further before investing. These bearish phases lead, at the same time, the “bears” (traders whose strategy consists in betting on the decline) to become much more present and powerful.

The term “bear market” is used for all types of markets, such as stock markets, traditional markets, real estate, or even cryptocurrencies.

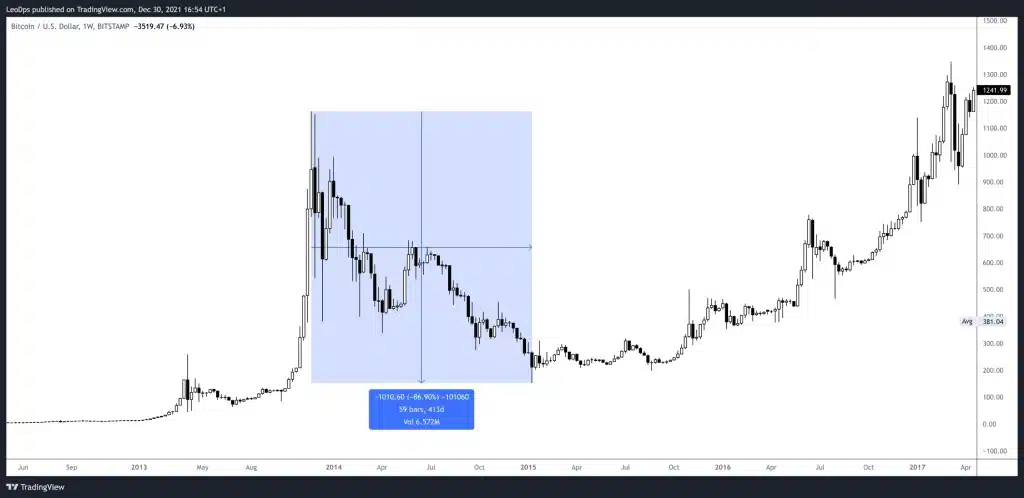

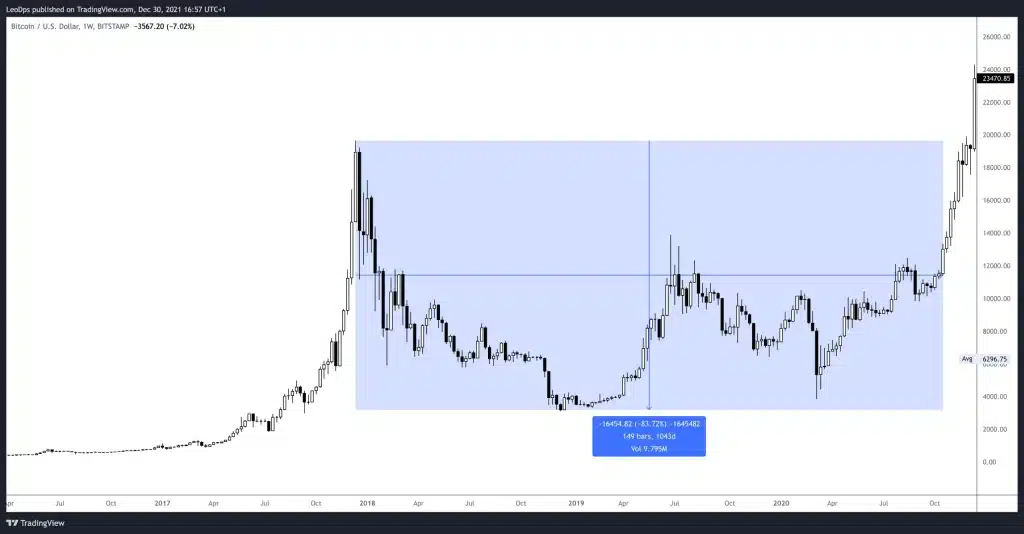

The cryptocurrency market is known to be one of the most volatile. Unlike traditional markets (like the stock market) that retrace 30-50% of their rise most of the time, the crypto market can face multi-year bear markets where price declines of -80% are not unusual.

Bear markets are also very good opportunities for both small and large long-term (institutional) investors to accumulate assets with strong fundamentals on their portfolios. Indeed, it is during horizontal depression phases called “accumulation phases” that the biggest ROI is found.

Although one cannot exactly predict the arrival or the end of a bear market, several financial tools, such as the Relative Strength Index (RSI) and Moving Averages (MA), are widely used to predict future reversals (both up and down), to try to enter or exit the market at the best times.