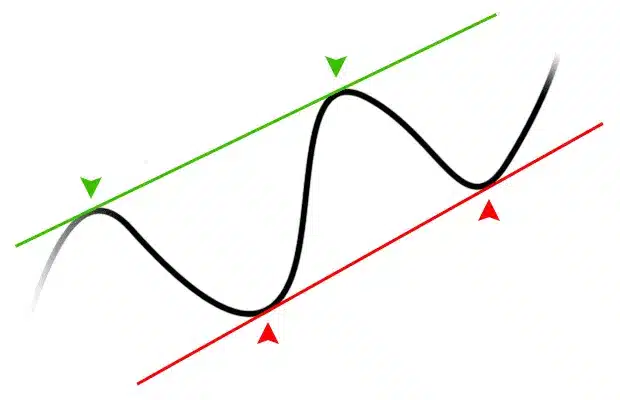

A bull market is a period of time when the price trend in a market is positive, i.e. there is more buying than selling and the economy continues to strengthen. In other words, the trend of a bull market is always upward, even during major corrections. As long as the price of a market does not break its long-term supports, a market remains in an uptrend.

A bull market is also characterized by the confidence of investors, which influences them to maintain optimistic psychology for months or even years, but which, according to past events, always ends in a general euphoria that is completely different from rational thinking.

It is interesting to note that in a market, the group effect is extremely powerful. When an entire market is optimistic, individuals tend to be overly optimistic because they are influenced by the group.

The term “bull market” is not only used to refer to the stock market, but also to the cryptocurrency market, the commodity market, or the real estate market. On the other hand, a very volatile bull market like the crypto market will tend to last much less time than the stock market, which exposes its investors to much more stable price changes. To name one that stood out, there was the crypto market that took place between 2015 and early 2018, during which almost all assets exploded to new heights.

Although we cannot exactly predict the arrival or the end of a bull market, several financial tools, such as the RSI and the moving averages, are widely used to anticipate future reversals (both up and down), in order to try to enter or exit the market at the best possible moment. Be aware that most of the entrants end up losing money sooner or later, mainly because of their crucial lack of knowledge and experience. So a word of advice, invest what you are willing to lose, and don’t forget to take profits regularly.