Binance negotiates with the DOJ to end the compliance monitor imposed since 2023, a major relief that would mark the end of three years of costly surveillance.

The potential return of CZ behind the scenes, combined with the improving regulatory climate in the US, restores confidence in the industry and repositions Binance as a legitimate player.

BNB hits a new all-time high at $962 with a 15% increase over the month, investors now aiming for the psychological threshold of $1,000.

An agreement that could erase three years of surveillance

Binance is reportedly in advanced discussions with the US Department of Justice (DOJ) to end one of the most burdensome clauses of its 2023 agreement: the presence of an independent ‘compliance monitor’ tasked with overseeing the company for three years. Imposed after the record $4.3 billion settlement in November 2023, this mechanism aimed to ensure the establishment of robust safeguards against money laundering and regulatory violations. If the DOJ agrees to lift this constraint, Binance would finally breathe a sigh of relief after two years under constant pressure.

Bloomberg notes that this decision would not be isolated: other giants like Glencore, NatWest, or Austal have already had their monitoring period shortened. Companies often criticize the cost and cumbersome nature of these external checks, sometimes seen as a hindrance to competitiveness. For Binance, the impact goes beyond mere administrative reduction. The removal of such monitoring would be seen as a sign that the exchange is definitively turning the page on its regulatory troubles in the United States.

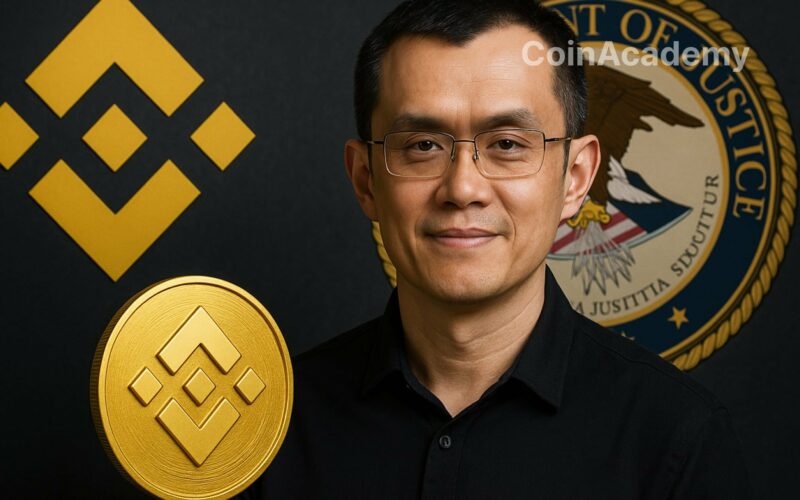

The gradual return of CZ to the scene

Another detail stirring up the community: Changpeng Zhao, founder of Binance and a central figure in the crypto world, recently added ‘Binance’ to his bio on X (formerly Twitter). An apparently insignificant gesture, but laden with symbolism. Removed after the agreement with the DOJ, CZ may be preparing for his comeback behind the scenes, just as his company is gaining ground. For many, this signals that the ‘Binance saga’ is entering a new chapter.

Political Context: Favorable Winds for Crypto

These discussions come at a time when US regulation seems to be easing. The Trump administration is pushing a pro-industry approach, including the GENIUS Act on stablecoins and the SEC’s declared end to the ‘regulation by enforcement’ policy. Rules are becoming clearer, including on key issues like liquid staking. The result: a much more transparent environment for crypto companies, and thus an ideal window for Binance to reposition itself as a ‘compliant’ player without losing competitiveness.

BNB: The Token on Fire Right Now

BNB is currently trading around $955, confirming an impressive momentum. In just 24 hours, the token has gained another 3%, while the weekly increase is about 8%.

In the long term, BNB has surpassed a new all-time high at $962, a level never seen since its launch. Investors are now eyeing the symbolic threshold of $1,000, which has become a major psychological target.

This rapid ascent reflects a renewed confidence around Binance and its ecosystem, as regulatory winds begin to shift in favor of the sector. For many, the performance of BNB is the perfect barometer of the platform’s comeback.