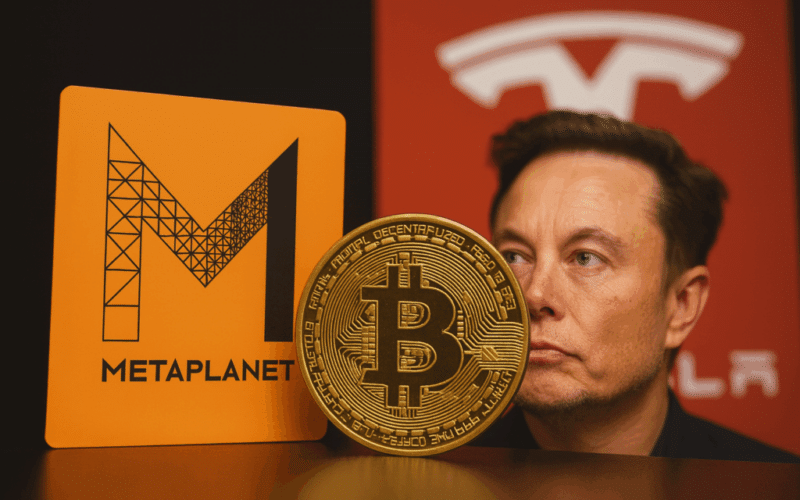

Metaplanet now holds 12,345 BTC, surpassing Tesla (11,509 BTC) and becoming the fifth-largest company globally in Bitcoin reserves.

Metaplanet surpasses Tesla with over 12,000 BTC

Metaplanet now holds more Bitcoin than Tesla. The Japanese company listed in Tokyo has reached a new milestone with 12,345 BTC in reserve, compared to 11,509 BTC for Elon Musk’s firm. A significant number that propels Metaplanet to the fifth spot globally among companies holding the most BTC.

In a market where strategic positions are staked with hundreds of millions, Metaplanet is making waves.

Swift accumulation at an average price that raises eyebrows

In just June 2025, Metaplanet acquired 1,234 BTC for $133 million, at an average purchase price of $107,877 per unit. This brings its overall average cost to $98,303 per BTC, a high price indicative of a calculated bet on long-term growth.

At the time of purchase, the Bitcoin price hovered around $107,000. The company is therefore close to breaking even on its positions, but remains vulnerable to volatility.

Behind the crypto behemoths, but ahead of Nasdaq giants

With this move, Metaplanet surpasses Tesla in the global ranking of companies’ Bitcoin treasuries. Only pure crypto players are ahead: Marathon Digital (MARA), Galaxy Digital, Riot Platforms, and of course, MicroStrategy, a pioneer and absolute leader with over 570,000 BTC in reserve.

This rise underscores a broader trend: Japanese companies are finally embracing Bitcoin on a massive scale. A trend once timid, now propelled by Metaplanet’s aggressive example.

A strategy inspired by Saylor, but with riskier timing

Metaplanet aligns with the strategy initiated by Michael Saylor, who has made Strategy a symbol of the “Bitcoin as treasury reserve” thesis. However, while Saylor accumulated as early as 2020, often between $10,000 and $40,000, Metaplanet buys at the highest point, and with its own funds.

A bold bet, especially in a still uncertain macro context.