The Federal Reserve leaves its key rate at 4.25-4.50%, an expected decision accompanied by a more cautious tone.

The Fed maintains its rates between 4.25% and 4.50%

The verdict is in: the rates remain unchanged. On Wednesday evening, the Federal Reserve kept its key rate between 4.25% and 4.50%. A expected status quo, but one that hints at a change in tone. The American economy is slowing down, inflation is persistent, and hopes for rapid rate cuts are fading.

Meanwhile, Bitcoin is at a standstill, hovering around $104,000. But do not be fooled: the price stagnation masks palpable tension.

Less growth, more inflation: cooling projections

The Fed revises its estimates: the GDP growth for 2025 is now estimated at 1.4%, down from 1.7% in March. A revision that speaks volumes about the economic reality. On the inflation front, a similar inverse trend: the PCE index is expected to reach 3%, compared to 2.7% in the previous forecasts. As for the core PCE, which excludes the most volatile elements, it climbs to 3.1%.

In essence, the dynamics are doubly unfavorable: slowing growth, persistent inflation. And that’s not all.

Rates will decrease less quickly than expected

The famous ‘dot plot,’ an internal projection tool of the Fed, now indicates a rate of 3.9% by the end of 2025. This translates to only 50 basis points of decline this year, exactly what the Fed had already announced in March. But for 2026 and 2027, the expectations are even more modest: 3.6% and 3.4% respectively.

In other words, if monetary easing happens, it will be slow. Very slow.

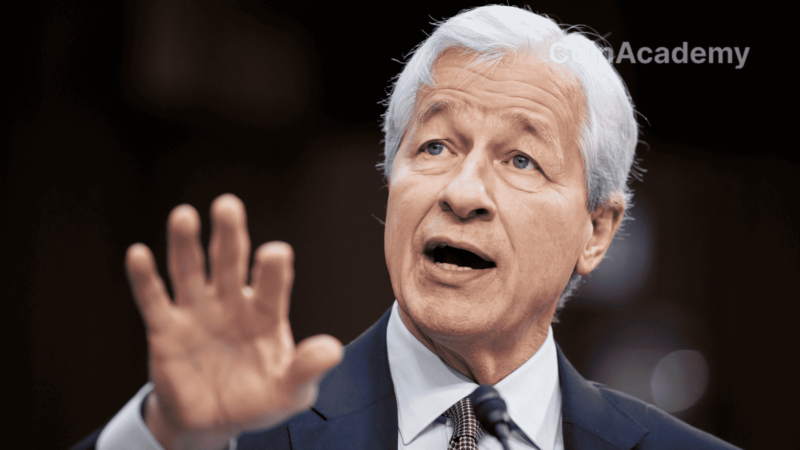

Powell remains cautious: ‘Well-positioned to wait’

The Fed’s chairman, Jerome Powell, hasn’t loosened the reins. During his press conference, he acknowledged that ‘short-term inflation expectations have increased,’ citing the effects of ‘tariffs as a driving factor.’ But he insists:

Most long-term inflation measures remain aligned with our goal.

Translation: the urgency is no longer there. The Fed believes it is ‘well-positioned to wait before making any policy adjustments.’ Another significant sign: the omission in the statement of a key phrase about ‘risks related to high unemployment.’ A withdrawal that suggests that the priority remains price stability, even at the cost of a slightly less tight job market.

Crypto impact: a deceptive calm

Bitcoin remains calm… for now. The lack of surprises in the announcements did not trigger major movements. But the equation is becoming more complex: between persistent inflation, sluggish growth, and stagnant monetary policy, the crypto markets will have to navigate cautiously.

And when the Fed hesitates, any future statement could tip the scales.