CME Group and Google Cloud Collaborate to Launch Universal Ledger for Financial Institutions

CME Group, a leading derivatives marketplace, has partnered with Google Cloud to explore the potential of asset tokenization through the Universal Ledger, a blockchain infrastructure specifically developed for traditional financial institutions. The integration of this tool aims to redefine payment mechanisms, settlement, and collateral management in capital markets. The pilot project, announced on March 25, is set to commence in 2026 with the active participation of institutional actors.

Terry Duffy, CEO of CME Group, envisions a disruption of the existing model. According to him, the Universal Ledger could generate significant efficiency gains for collateral, margins, settlements, and fee payments as the world moves towards continuous, 24/7 trading.

The Rise of Tokenization as the Future of Markets

Tokenization, the process of converting financial or real assets into digital tokens on a blockchain, is emerging as a major trend in the financial landscape. A report from the World Economic Forum, published on March 24, states that the integration of traditional finance and blockchain technology is finally becoming a reality. Yuval Rooz, co-founder of Digital Asset, believes this transition could unlock a pool of liquidity that remains untapped. Currently, only $25 trillion in securities are eligible to be used as collateral, while the total potential is estimated at $230 trillion.

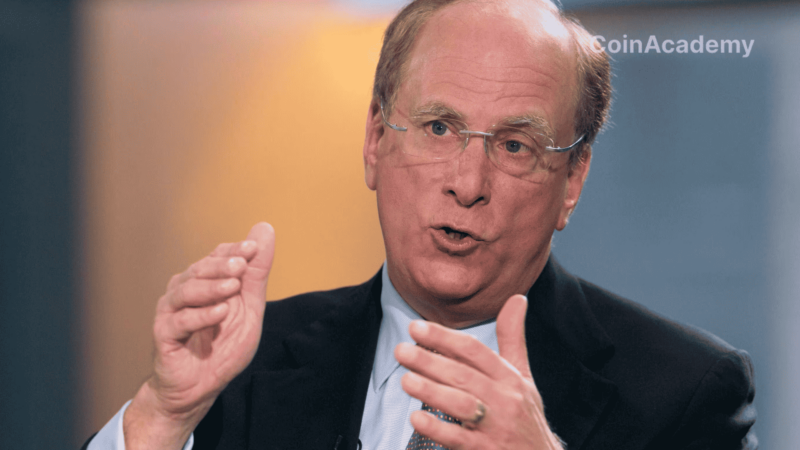

Larry Fink, CEO of BlackRock, has also expressed support for the tokenization of financial securities. In an interview with CNBC in January, he urged the SEC to quickly approve this new form of digital securities, highlighting the efficiency gains it could bring to financial markets.

Google Cloud: A Silent Pillar of Blockchain Infrastructure

Since 2018, Google Cloud has been steadily building a robust offering around blockchain. It started by integrating Bitcoin blockchain data into its data warehouse and then added 11 new blockchains, including Ethereum, Arbitrum, Avalanche, and Optimism, in 2023. With the launch of the Universal Ledger, the company is taking on a much more ambitious phase: offering a distributed ledger architecture designed to meet the strict requirements of institutional finance.

The RWA Market Reaches a Milestone

Excluding stablecoins, the market capitalization of tokenized Real World Assets (RWAs) is already nearing $20 billion, according to RWA.xyz data. This figure is still modest on a global scale but is growing rapidly, supported by a more favorable political climate in the United States. In fact, candidate Donald Trump promised to make the United States the global capital of blockchain and cryptocurrencies.

The recent questioning of SEC Directive SAB 121 also opens up new possibilities. According to the Tokeny platform, this regulatory evolution will allow institutions to offer custody services for tokenized securities without exposing themselves to excessive financial risks.

A Global Race for the Finance Infrastructure of the Future

The CME and Google Cloud project exemplifies a fundamental trend: large technology and financial companies are no longer content to observe the evolution of Web3; they are now taking the lead. The next decade could witness the gradual disappearance of traditional settlement systems in favor of a more fluid and interconnected finance operating in real-time on next-generation infrastructures.