Charles Schwab, with $7 trillion in assets under management, plans to integrate spot crypto trading into its offerings as soon as regulations allow.

The imminent departure of Gary Gensler and Donald Trump’s pro-crypto policy could accelerate Schwab’s crypto services launch.

Schwab anticipates increasing demand for digital assets while maintaining a measured approach to protect its clients and reputation.

Charles Schwab Ready to Launch Crypto Trading

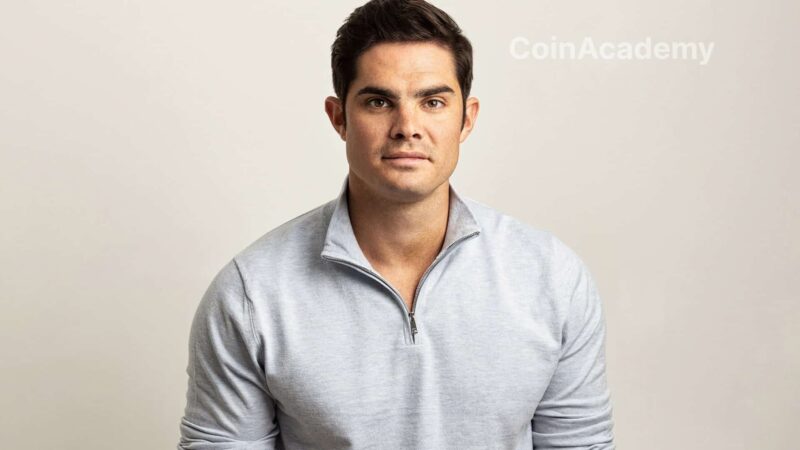

Charles Schwab, one of the giants in financial services in the United States with $7 trillion in assets under management, is preparing to offer direct crypto investments to its clients as soon as the regulatory framework becomes more favorable. Rick Wurster, current president and future CEO starting from January 1, 2025, confirmed this ambition in an interview with Bloomberg. Currently, the company offers crypto-related products such as ETFs and futures contracts, but aims to integrate spot trading into its portfolio of offerings.

This announcement comes as financial products related to crypto experience rapid growth in the United States. According to the latest data, Bitcoin Spot ETFs saw their total net value surpass $100 billion this week, a sign of the growing appetite among institutional investors for digital assets.

A Turn Supported by a Favorable Political Context

Schwab’s initiative comes at an optimistic market climate, marked by the reelection of Donald Trump, whose electoral program heavily focused on the development of cryptocurrencies. Trump promised favorable measures to the ecosystem, such as creating a strategic Bitcoin reserve for the country, increased support for crypto mining, and the promotion of decentralized finance technologies. Additionally, the announced departure of Gary Gensler, current chairman of the Securities and Exchange Commission, scheduled for January 2025, could pave the way for a more lenient regulatory approach.

Gensler, often seen as an adversary of cryptocurrencies due to his actions against major players such as Coinbase, Binance, and Kraken, symbolized an era of strict control. His departure is seen by many observers as a pivotal moment for the crypto sector.

Rick Wurster: A Measured yet Ambitious Approach

“Cryptocurrencies have certainly caught the attention of many people who have made a lot of money through them. I have not bought any cryptocurrencies, and I feel silly.”

While Schwab prepares to fully embrace the crypto market, Rick Wurster made it clear that he does not plan to personally invest in digital assets. This personal reserve contrasts with the company’s strategic vision, which aims to offer its clients investment opportunities in a rapidly expanding sector.

This strategy reflects a growing recognition of customer demand for crypto products as well as the importance of keeping pace with the swiftly evolving digital asset market. Schwab also appears to want to capitalize on the increasing popularity of cryptocurrencies as institutional financial instruments by diversifying its services to remain competitive against traditional finance players adopting similar approaches.