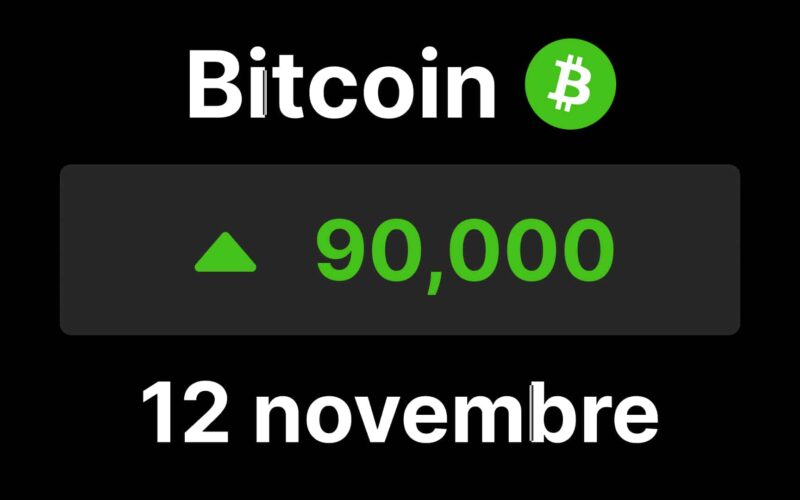

Bitcoin reaches new all-time high of $90,000 following Donald Trump’s election victory, as investors anticipate a crypto-friendly government.

Unprecedented Rise of Bitcoin

Since Donald Trump’s decisive election victory, the crypto market has been soaring. Bitcoin, the largest cryptocurrency, recently surpassed a new historical milestone, reaching $90,000 per BTC on the Coinbase platform. This spectacular surge comes as investors anticipate a more crypto-friendly government, thus reevaluating the valuation of digital assets.

The Impact of Massive Liquidations

The sharp price movements resulted in the liquidation of leveraged trading positions, totaling nearly $940 million in digital derivatives over a 24-hour period, according to CoinGlass data. This represents the largest wave of liquidations since the crash on August 5, when carry trade liquidations on the Japanese yen temporarily pushed BTC below $50,000.

Anticipation of a Pro-Crypto Era

The bullish momentum is driven by renewed optimism towards the Trump administration, which is perceived as being pro-crypto by market participants. The combination of factors such as decreasing inflation, strong economic growth, and global monetary easing supports this rush towards risky assets, with Bitcoin being the primary beneficiary. Institutions, sensitive to political orientations, are positioning themselves accordingly, leading to an influx of capital into digital markets.

Towards New Highs?

With BTC defying expectations and previous highs, the question arises as to how far this bull run can extend. Investors are closely monitoring the next steps in economic and monetary policy, and optimism is abound. Signals of more lenient regulations and increased support for financial innovations by the government could potentially reshape the market’s trajectory in the months to come.

In this context, the impact of institutions on Bitcoin’s dynamics is more evident than ever. Their behavior could determine the next stage for the crypto market: either a short-term consolidation or a continuation towards even higher highs.