The SEC has admitted that it regrets using the term ‘crypto asset securities’ in its legal action against Binance, clarifying that this term did not directly refer to the tokens themselves as securities.

SEC’s Surprising Reversal

In its ongoing litigation against Binance, the SEC made a surprising admission, stating that it ‘regrets’ using the term ‘crypto asset securities’ to directly refer to cryptocurrencies.

This clarification came in a footnote in a proposed amendment to its complaint against Binance, where the agency initially classified tokens like SOL, ADA, and MATIC as securities.

Skeptical Reactions from the Crypto Community

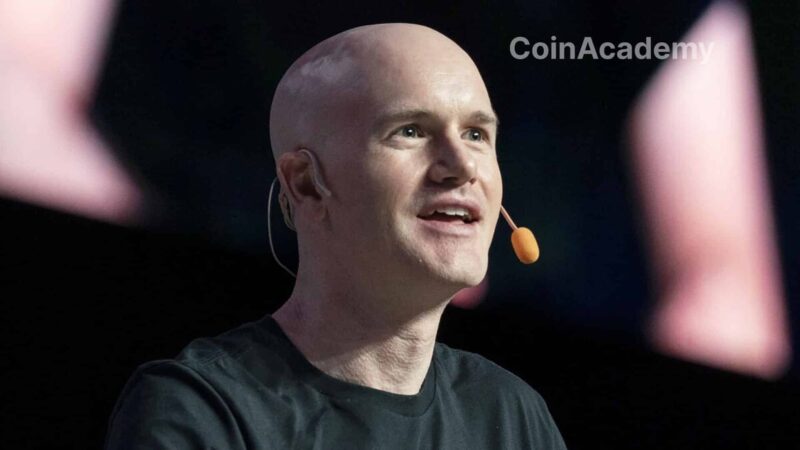

Paul Grewal, Coinbase’s Chief Legal Officer, pointed out that in a case against Ripple, the SEC referred to the XRP token as a ‘security,’ reinforcing the idea that the agency has often used this terminology ambiguously.

Stuart Alderoty, General Counsel of Ripple, also criticized the SEC, stating that it needed to admit ‘that it has become a knot of contradictions.’ He highlighted that the SEC finally acknowledged that the term ‘crypto asset security’ was made up and that to establish an asset as an investment contract, the agency had to prove the existence of a set of ‘contracts, expectations, and understandings.’

The Legal Context of Binance

The SEC filed a complaint against Binance for alleged violations of U.S. securities laws, specifically the sale of cryptocurrencies that the agency considers investment contracts. However, in 2024, the SEC stated its intent to amend its complaint to remove the need for an immediate ruling on these specific token-related allegations.

Recently, the SEC expanded its claims against Binance to widen the scope of its allegations. The updated SEC filings now list additional tokens, including AXS, FIL, ATOM, SAND, and MANA, as securities.

The Controversial Stance of Gary Gensler

Gary Gensler, the Chairman of the SEC, has become a controversial figure in the crypto world for his strict and sometimes perceived as vague approach. He has repeatedly stated that the majority of cryptocurrencies should be considered securities, while demanding that crypto exchange platforms register with the SEC. However, many industry companies argue that complying with these requirements is nearly impossible given the current regulatory framework.

The dispute between the SEC and the crypto industry reflects a larger issue: how digital assets should be regulated. While the SEC tries to enforce existing laws, crypto companies insist on the need for a framework that is more tailored to the specifics of this new asset class. The debate is far from settled, and decisions made in cases like Binance could have profound implications for the future of cryptocurrency regulation.