Key Points:

- The Securities and Exchange Commission (SEC) has sought summary judgment against Do Kwon and Terraform Labs.

- In opposition, Terraform Labs’ defense contests the classification of their tokens as securities.

- The SEC presents evidence that it believes clearly demonstrates that Kwon and Terraform Labs misled investors.

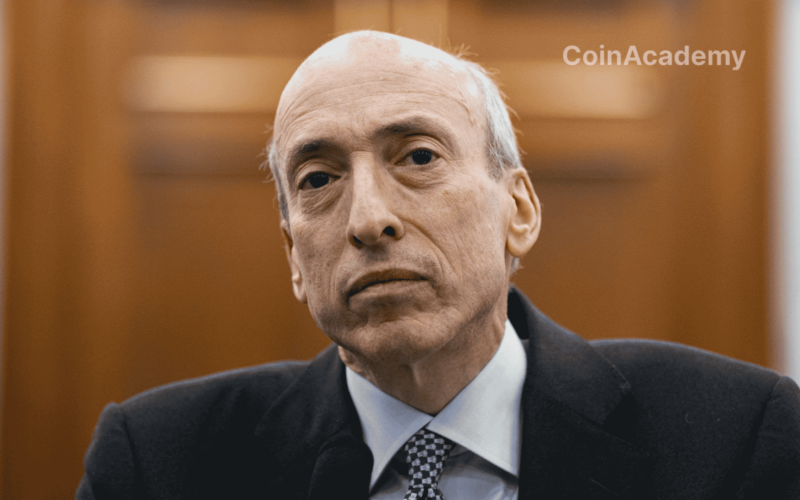

SEC Claims Jury Too Lenient Towards Do Kwon

The United States Securities and Exchange Commission (SEC) has recently requested a summary judgment in the case involving Do Kwon and Terraform Labs, seeking to avoid a full trial by asserting the self-evidence of the facts.

Indeed, the SEC has presented evidence indicating that Do Kwon misled investors by marketing Terra (LUNA) tokens as securities.

The U.S. regulation, through the Howey test, defines the criteria for an investment to be considered a security. The SEC argues that Kwon’s and Terraform Labs’ actions clearly fall within this framework, accusing them of fraud and misleading statements regarding the stability of their stablecoin UST.

There is no doubt that buyers invested money, whether through fiat currency or cryptocurrency assets […] No rational jury could conclude that Kwon was not responsible for Terraform’s violations.”

– stated the SEC

Terraform Labs’ Defense

In response, Kwon’s defense team has asked the court to dismiss the SEC’s complaint, arguing that the assets in question, including LUNA and MIR, do not constitute securities under current legislation.

They added that the SEC has failed to prove that Terraform Labs was offering securities.

The Impact of This Case on the Ecosystem

The collapse of Terra in May last year led to the loss of billions of dollars belonging to millions of investors. Daniel Shin, co-founder of Terraform, attributed this failure to Kwon’s poor management.

Meanwhile, Kwon faces charges in Montenegro for document forgery.