What is the Funding Rate – Basics

The funding rate, also known as the financing rate, is the commission that is paid by actors who take positions on perpetual markets. Whether they are long or short, the funding rate is billed to market actors on a regular basis.

- If the funding rate (or financing rate) is positive, buyers (long positions) pay these fees to sellers (short positions).

- If the funding rate is negative, sellers (short positions) pay these fees to buyers (long positions).

Therefore, this funding has the function to maintain a high correlation and equivalency between the spot price and the price of derivatives of a crypto asset.

This process discourages actors to manipulate derivatives markets, which could lead to a decorrelation of derivatives prices in relation to spot prices (which would have a catastrophic impact).

How to use the funding rate in trading?

When the funding rate is positive

Most of the time, the funding rate on cryptocurrencies is positive.

If the price of Bitcoin explodes upwards and actors speculate on its derivatives, the spot price and the price of derivatives can be temporarily decorrelated.

In order to limit and correct this decorrelation, trading platforms increase the funding rate in order to discourage long positions and attract short ones.

In this case, why is it important to remain careful when the funding rate is very high?

This is a legitimate question. Even at 0.3% or 0.4% (in rare cases), the funding rate should not discourage actors to take buying positions.

However, it might discourage heavy wallets. Indeed, for most people reading this article, the funding rate will not affect your results in the slightest. On the other hand, crypto whales who make orders for millions of dollars cannot ignore the funding rate, as it could cost them a lot.

A very high funding rate does not necessarily mean that you have to sell. It simply means that strong hands have an interest in going short. In the case of a trading range, for instance, sellers could take back the lead.

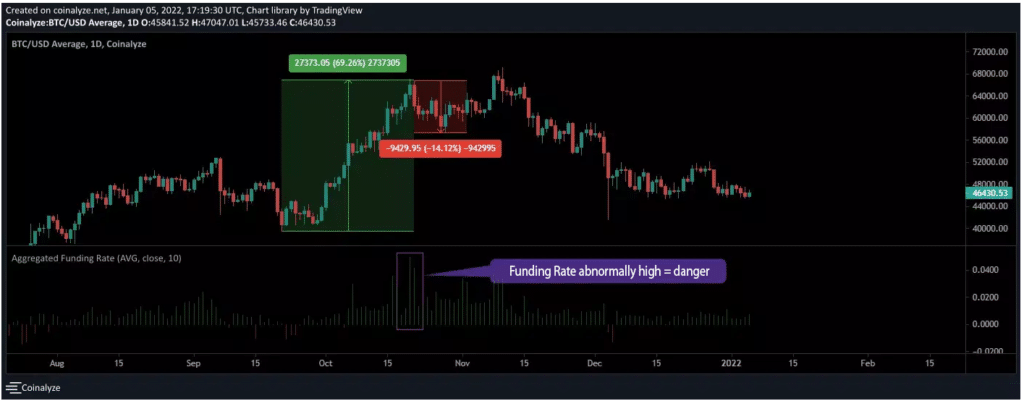

Example with Bitcoin

After a bullish rally that lasted several days, the funding rate of Bitcoin increased at an abnormal rate. We can infer from this anomaly that a high number of individuals wanted to make the most of this bullish trend. In many cases, these positions are opened by traders who are afraid to miss an opportunity after a significant market trend.

The next day, we can see an important increase of the funding rate: the price is corrected by a factor of 15% and latecomers suffer from their emotiveness.

Counter-example with Bitcoin

The funding rate remained extremely high throughout January and until the crash in May. However, the peaks of the funding rate went lower and lower, indicating a buying weakness.

When the Funding Rate is negative

This is a much rarer case; a negative funding rate often occurs after a strong bearish trend.

In the vast majority of cases, the funding rate does not stay low for a long time. It quickly returns to a positive value. Much like when the funding rate is very high, latecomers want to profit off of its decrease at the worst time (often in cases of major market support).

Let us zoom in on the rebound that occurred in late July of 2021:

At the end of July of 2021, the price of Bitcoin makes a 46% rebound in a matter of a few days while the funding rate remains relatively stable.

This is a highly bullish signal. The market actors have resigned and are in denial. They try to go short and to trade against the market trend, which can often be catastrophic.

Conclusion on the Funding Rate

Like any indicator, the funding rate must be combined with many other factors, such as the Price Action or the Open Interest.

Still, it is an excellent indicator of the current psychology of actors on the market (who are often overexposed or in fear).