The American Federal Reserve has decided: its benchmark rate falls by 25 basis points, to range between 4% and 4.25%. This marks the first cut of the year 2025, announced tonight at 8 pm (Paris time). Behind this move, a clear realization: employment is slowing down, and the focus now shifts from inflation to supporting the labor market.

The message from the FOMC (Federal Open Market Committee) is straightforward: “Job creation is slowing down, and unemployment is slightly increasing.” In essence, the Fed acknowledges that the job market, long seen as indestructible, is starting to weaken.

New rate cuts expected this year

Official projections anticipate an additional 50 basis points cut by the end of the year. Subsequently, the pace would slow down: 25 basis points per year in 2026 and 2027.

Markets quickly adjusted their bets. On the Kalshi platform, traders estimate a 59% likelihood of exactly three rate cuts this year. Only 11% bet on four cuts, while 30% anticipate only two cuts.

But there is no unanimity at the Fed: Governor Miran voted against, advocating for a more aggressive 50 basis points reduction starting now.

Monetary policy under political pressure

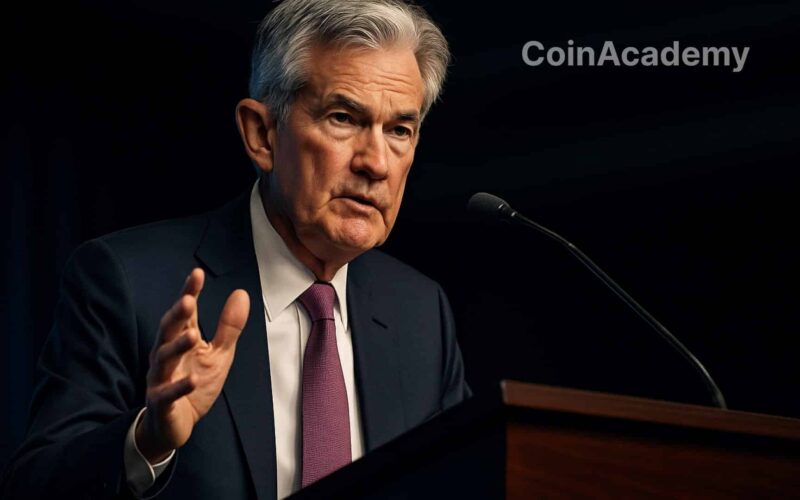

This decision is not just about economic logic. It comes as Donald Trump, in a heated confrontation with the institution, demands “massive and immediate” cuts. On Truth Social, he criticized Jerome Powell: “Too late! Rates need to be cut now, and much stronger! Housing will explode!“

The president has gone further in recent weeks, even trying to remove Governor Lisa Cook by accusing her of mortgage fraud, allegations she vehemently denies. This open war with the Fed adds a burning political dimension to monetary decisions.

Immediate market reactions

Wall Street did not cheer: the S&P 500 dropped by 0.2% and the Nasdaq by 0.7% following the announcement. In the crypto arena, Bitcoin briefly wavered before slipping below $116,000, down 0.7% for the day.

This cautious reaction reflects a dilemma: a rate cut should support risky assets, but job market concerns weigh heavy. Investors wonder if this decision marks the beginning of a sustained easing cycle, or a sign that the Fed sees the American economy already faltering.

What lies ahead for the markets

The future will depend on how quickly the American economy digests Trump’s tariffs and the job market slowdown. If the Fed sticks to its schedule, 2025 could mark a turning point for stocks and crypto markets, stepping out of the shadow of restrictive monetary policy.

But one message remains clear: the Fed is no longer solely obsessed with inflation. Its new mantra is employment, and it is a change of direction that Wall Street and Bitcoin investors will closely monitor.