What is called Tokenomics (composed of the words Token and Economy) represents, for a crypto project, how the creation of tokens will be managed for the good functioning of the project. This management of creation already exists for the “fiat” monetary systems and allows a follow-up of the inflation phenomenon. Tokenomics is finally the monitoring of this phenomenon applied to cryptocurrencies.

In addition to this definition, the participation in the governance of certain DeFi projects (decentralized finance) makes the creation of communities of users who monitor the evolution of the project over time possible.

History to understand the stakes of Tokenomics

While the word may seem complex at first glance, the idea is actually quite simple. The media generally talks about inflation to highlight a rise in the price of everyday consumer goods. In truth, it is not the prices that tend to rise, but the value of money that tends to fall.

Inflation is a phenomenon that has marked many reigns, and if Philip IV “the Fair”, King of France, had found a solution by changing currencies excessively to devalue those on which his debts were based, the example of Philip II, King of Spain in the 16th century allows a good understanding of the problem.

In the 16th century, Spain conquered Latin America and discovered an immeasurable wealth: gold and silver mines were hidden deep in the Andes Mountains. Silver ore turned out to be particularly abundant.

The Kingdom of Spain has made a fortune, but its financial situation has not improved. Indeed, silver ore is particularly used as a refuge value in Latin countries. The majority of coins are made of silver. The problem comes from the fact that the Crown of Spain is over-indebted to many European creditors, including Charles V prince of the house of Habsburg. The numerous silver ingots only made a quick passage through Spain and mainly swelled the coffers of its French and Dutch neighbors. Thus, the European market ended up being flooded with silver so that the immense Spanish wealth was diminished as the ore abounded on European shelves.

Finally, the too large quantity of imported money was distributed in Europe, which caused an important devaluation of what Philip II could think to be his El Dorado. Better management of its finances could have allowed him to preserve its reserves of precious minerals, and thus to be able to develop on a more significant scale of time his fabulous treasure.

This story shows the importance of the quantity put into circulation on the valuation of an asset. Like the cryptocurrency market, any analysis of an asset’s ecosystem requires careful attention to the concepts of quantity available, total quantity, and inflation management.

Tokenomics, the golden rule of the digital asset economy

Tokenomics makes it possible to mark deep in the blockchain the rules governing the maximum quantity (we will often talk about total supply), the monetary issuance, and the distribution of digital assets (if necessary, some projects can distribute a certain part of the tokens to a certain entity, the project’s team of developers for example).

It is thus with interest that any investor must linger on these characteristics, since they can have a great influence on the valuation of the token. It is generally detailed in the white papers produced by the development teams at the time of ICO (initial coin offering).

The three components of tokenomics

The total supply

The total supply represents the maximum quantity of tokens that can be issued by the operation of the blockchain. In this case, a distinction must be made between available quantity and total quantity. The available quantity represents the number of tokens already issued at a given time, those that you and I can already buy on an exchange like Binance or FTX. The total quantity represents the maximum quantity that the number of tokens in circulation will eventually reach. So, for Bitcoin, 21 million tokens will be mined on this blockchain, no more, no less.

The issuance

It is the number of tokens created and paid out to the validators of a blockchain according to a determined period of time. Indeed, the validators of a blockchain network (generally called Miners in the case of blockchains based on the proof-of-work model such as Bitcoin) earn rewards for their participation in the operation of the network: firstly, a certain quantity of tokens issued for each new block created, and secondly, the transaction fees paid by the network user.

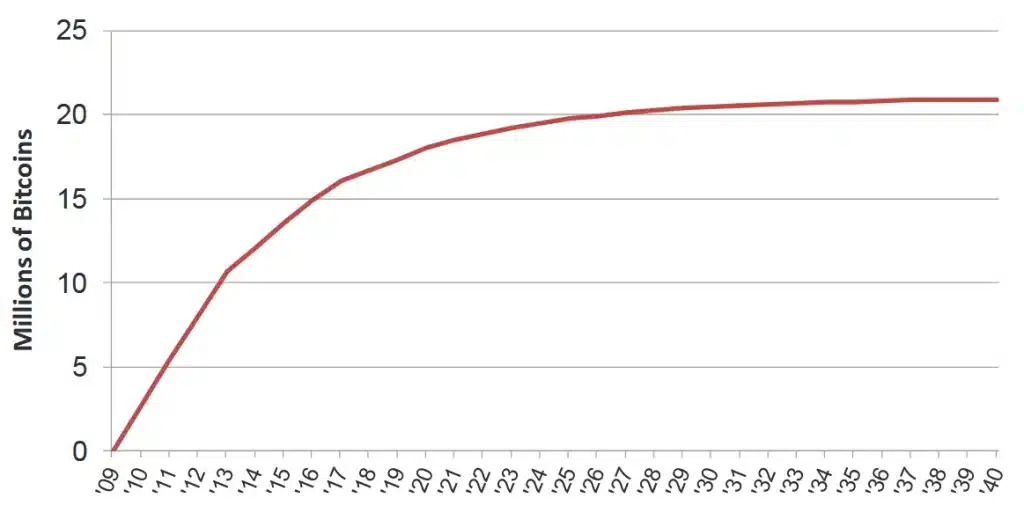

It is clever to note that for blockchains whose tokens are quantitatively limited, the issuance of these tokens is governed by a disinflation system (i.e., the reduction of the inflation rate over time). In the case of Bitcoin, the so-called Halving is an event that occurs every four years. It is the halving of the amount of Bitcoin issued by the blockchain for each block created. Thus, Bitcoin miners in 2009 received no less than 50 BTC per block created (the time to create a block is about one second for Bitcoin). In 2013, they received only 25, then 12.5 in 2016, etc.

This system of disinflation has allowed the Bitcoin economy to grow as its capitalization increases. Eventually, the last Bitcoin will be mined in 2140, after which miners will only be compensated on the transaction fees paid by users.

The distribution

Most public blockchain projects provide for the distribution of a share of the total supply to certain actors or for certain specific uses. For example, the founders of the Zcash corner received a distribution equivalent to 10% of the total supply (2,100,000 tokens, or more than $157 million as of the last distribution on November 30, 2020).

In contrast, the Bitcoin tokenomic did not provide for the distribution of tokens to its creator. Satoshi Nakamoto, whose real identity is still unknown, is said to hold a large number of tokens (it is said to be about a million tokens). Nevertheless, this is due to the high probability that he was probably the only or one of the only Bitcoin miners at the time of its creation. It should be noted that this does not fail to worry a part of the doctrine which believes that in the absence of minimal knowledge of the interests of the creator of Bitcoin, systemic risk will hang over the Bitcoin ecosystem.

Other projects include an allowance for marketing or even an allowance to be redistributed as is available to Brave users in Basic Attention Token.

ICOs play a predominant role in the distribution of tokens by allowing new projects to raise funds by allocating a portion of the circulating tokens to a segment of the community, private investors, or any potential buyer.

However, not all blockchains are governed by the same operation.

Two predominant models of tokenomics

This article will not go as far as explaining all the existing systems because of the large number of variants that can be added to the code of a blockchain. We will therefore study the two most common models:

The quantity-limited disinflationary model:

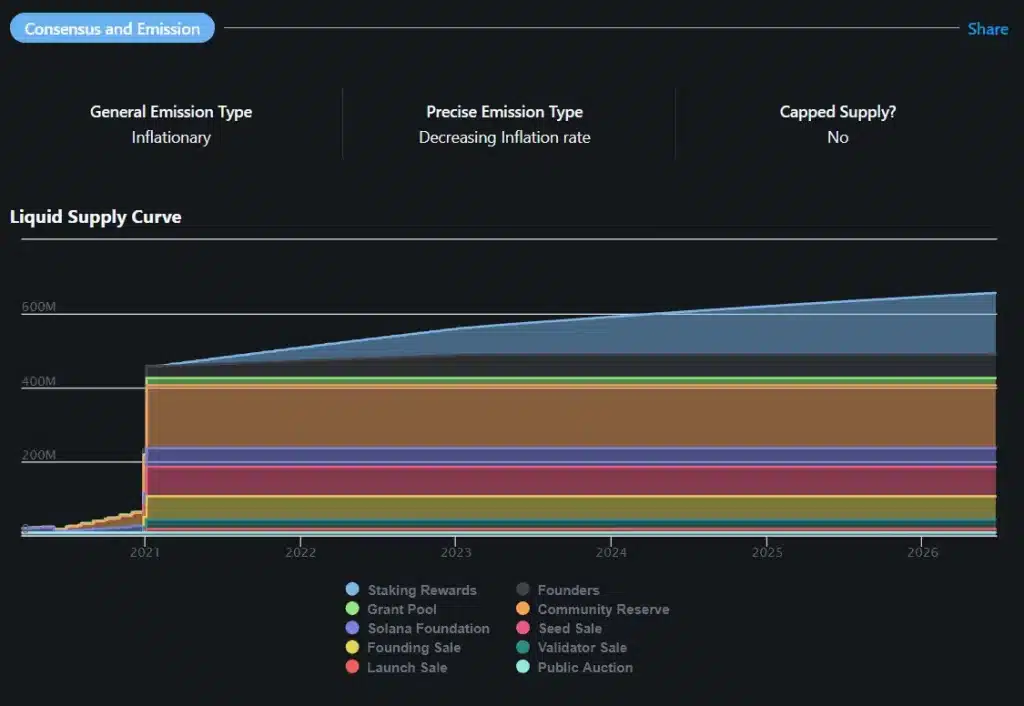

This is simply the way Bitcoin works, namely a limited amount of money is issued in the future and less and less money is issued over time. Many cryptocurrencies are governed under this model, it is possible to mention Solana, Litecoin, BAT, Tron, and many others alongside the king of cryptos.

The balanced inflation model:

Many blockchains have been coded without incorporating a limited amount of token issuance. This choice can be made for various reasons, usually involving the intended use of the blockchain in question.

For instance, this is the model under which the Ethereum protocol operates. However, some mechanisms are put in place to limit inflation, or even to create a deflationary system.

This is the objective of the implementation of future updates of the Ethereum network: while the annual rate of issuance of ETH tokens is currently equal to nearly 4.5%, the shift from Proof of Work to Proof of Stake should allow developers to reduce this rate to less than 1%.

In addition, the update entitled EIP-1559 will introduce a burning system, meaning that a portion of the fees paid by Ethereum users in the future will not be returned to the validator, but removed altogether. This could not only achieve a balance with the issuance rate, but potentially lead to a decrease in the number of tokens in circulation in case of high network usage.

Both models have their strengths and weaknesses, and the justifications behind their operation are of great interest.

Thus, with regard to Ethereum, the white paper indicates that a stable issuance rate would make it possible to avoid the excessive concentration of wealth in the hands of a few actors/validators.

Bitcoin’s disinflationary system, as previously stated, allowed for the growing development of its ecosystem by paying miners large amounts of Bitcoin when it was not worth the tens of thousands of dollars it will be worth in 2021.

Influencer sur la gouvernance de projets crypto

This is one of the main interests of participating in an ICO: to have the possibility to hold a sufficient quantity of coins at a low cost to influence the future of the project.

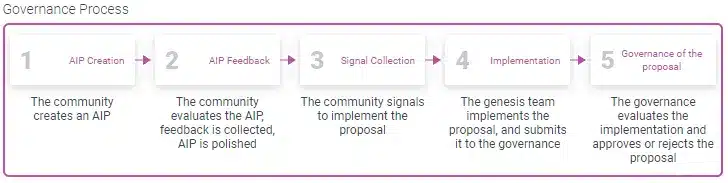

This particular use of the token is generally found in many challenge projects like AAVE on Ethereum or PancakeSwap on BSC. Holding tokens allows voting for certain decisions impacting the platform (future listing of a new corner, allocation of resources, burn of tokens, etc.).

For example, AAVE coin holders can influence the management of certain features of the platform: the AAVE coin allows its holders to modulate the rewards allocated to two distinct uses:

- The use of the platform (lending or borrowing) is rewarded with a percentage of the money left in escrow or borrowed in AAVE. This allows the platform to encourage new users.

- Stacking rewards allocated to AAVE coin holders who participate in the platform’s security system (an insurance fund is set up in case of security problems).

The AAVE coin also allows you to propose possible improvements, which will lead to its vote by the community in the end.

What is known as tokenomics refers to the set of rules governing the ecosystem of a token and the use that the community can make of it. It is therefore essential information to know for any investor wishing to participate in the crypto environment, especially since the cryptocurrency ecosystem remains deregulated and therefore prey to many malicious intentions. Do Your Own Research (DYOR) as people would say.